How much is general liability insurance?

The cost of general liability insurance is offset by the benefits it provides if you happen to find yourself in a pickle. GL protects your business against mishaps that can happen when you run a business — bodily injury, property damage, personal and advertising injury, and medical costs. A general liability insurance quote is the perfect place to start protecting your business. It’s a great coverage without being unreasonably expensive.

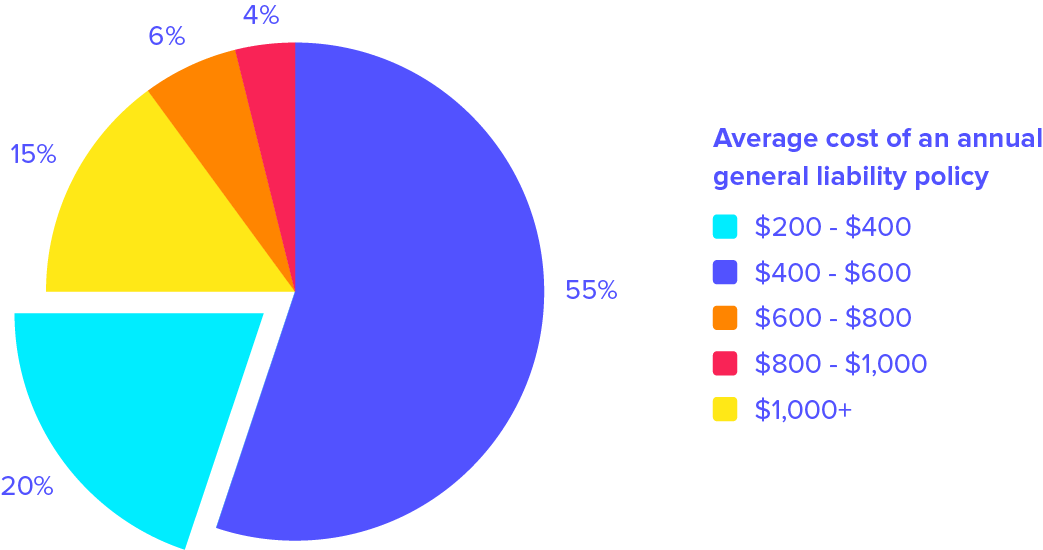

Like many things in life, general liability insurance costs are based on your unique situation. But for starters, a one-person business may pay around $400/year for a general liability policy. That’s just $33 per month. But the bigger your business gets, the more you will pay. A self-employed business owner will likely pay less for insurance than a corporation. Costs can be as low as $250 and as high as $2000 per year. It all depends.

Below are some sample insurance estimates, but keep in mind that these are only estimates. The best way to find out exactly how much small business insurance will cost is to get a quote. We’ll compare over 30 insurance companies to find you the best prices (at no extra charge).

General liability cost factors

General liability rates depend on several factors that insurance companies look at to determine your risk of a claim. That’s the gist of how insurance coverage works: More risk means higher prices.

Business location

Insurance prices vary by state (and sometimes zip code). If you own a business based out of New York City, you’re surely going to get more foot traffic than if you had a small shop in upstate New York.

The more you interact with the public, the higher your “premises liability exposure”. It basically means you face a higher chance of people getting hurt at your location. And if someone trips and sprains a wrist, for example, they’ll probably ask you to pick up the medical bills. Note: GL protects people who don’t work for your business. Check out our workers’ comp cost breakdown to see how much it is to protect your employees on the job.

That seems unfair — they should have been paying attention! But their argument is, it’s your property, and it was hazardous and caused an injury. Technically, you can be held liable.

Because general liability covers bodily injury, the price depends on your exposure to such liabilities. Typically, the higher the exposure, the more expensive your general liability insurance will be.

For example, far more people are likely to visit the hottest new juice bar than an accountant. No offense, accountants. But because the restaurant owner has more exposure than the accountant, the bill reflects the risk. The average cost of general liability insurance for a restaurant is around $775 a year, while a consultant typically pays an annual fee of $445.

Your profession

Commercial liability insurance prices are almost always impacted by profession. What you do for work will determine how much risk you face each day. The more risk you face, the more likely you are to have a claim. For example, general liability will cost more for a retailer because they have more foot traffic. But a freelancer who works from home will have much less exposure. And their liability insurance cost will be cheaper.

Meeting in person with clients

If you meet with your clients virtually, there’s essentially zero risk for a premises liability claim. But if you’re having physical meetings with clients at your office, the opportunity for claims increases.

Let’s say you’re having a meeting at your favorite coffee shop, and spill your latte on your client’s tablet, ruining the device. GL covers property damage, so that’s great. But keep in mind, the more you meet with clients in person, the more liability you face. The higher the liability, the higher the price tag of the policy.

Here’s another comparison: A real estate agent vs. a home-based business. It’s probably obvious who meets with clients more often. That’s why a real estate agent pays an average of $920 a year for a general liability policy, while a home-based business owner typically pays around $645 per year.

Cleaning businesses, construction businesses, and landscapers have some of the highest liability insurance costs. That’s because they do a lot of work that involves other people’s property, and GL pays for damage you or your employees cause to someone’s property.

Sales and Revenue

Insurance companies use sales as a measuring stick for risk. It makes sense: more action means more sales. The more action you have, the more interaction with customers. Since general liability insurance covers third party bodily injury and property claims more action means a higher price.

General liability policy costs

Many small business owners (with between 1 and 10 employees) can expect to pay somewhere between $400 and $650 per year for general liability insurance. That means, on average, you might pay around $40 a month for this policy.

Sure, there are many things you can do with $40 a month. Get your nails done, go to a few movies, fulfill your sushi craving, whatever. But if you don’t have general liability coverage, and something does happen, you might not be doing any of those things for quite a while.

It sounds crazy, but the average cost of a customer slip and fall accident is $20,000 dollars. You may not want to pay $40 a month for an insurance policy, but you probably never want to pay $20,000 in medical bills to some stranger who was clumsy enough to trip on the rug at your shop (and didn’t even buy anything)!

In the chart below, see how the price of a general liability insurance policy differs by profession. Keep in mind, these costs are based on $1M / $2M liability limits. (More on that below).

Liability limits are the maximum amount an insurance company will pay for a claim per policy period. The higher your risk, the higher you can set your liability limits. However, if you’re considered to be a low-risk business, you can opt for lower limits. Over 80% of businesses choose $1M / $2M liability limits, but other limits available are:

- $300K / $600K

- $500K / $1M

- $1M / $1M

- $1M / $2M

- $2M / $4M

As the limits increase, so will the price of the policy. Understanding coverage limits can be confusing, so feel free to reach out to one of our insurance experts with any questions.

Short-term policy cost misconceptions

Event policies are something you might purchase if you are hosting an event, like a conference or fundraiser. Event-based policies might seem cheaper up front, but they can really add up. If you think you might be working on more than one or two events a year, consider purchasing an annual policy — it could end up saving you money in the long run.

Looking for cheaper liability insurance?

BOPs, short for business owner’s policies, combine general liability insurance with business property insurance into a package deal. You get more coverage at a lower price than purchasing each of the policies on their own. Depending on your line of work, these bundled policies can start as low as $250 a year, which averages around $21 a month. (That way, you’ll still be able to get your sushi fix.) Read our BOP cost breakdown to learn more.

Additional Business Insurance Costs

Curious how much it’ll cost to insure your small business? We’ve made a few in-depth breakdowns of each business coverage cost to help out with that.

- Business Insurance Cost: A full breakdown of commercial business insurance costs — see what many small businesses pay each year.

- Professional Liability Cost: See how much it costs to protect yourself with e&o if you offer professional services.

- BOP Cost: Save a little money by bundling coverages– here’s what it’ll cost you.

- Workers’ Comp Cost: Check out how much it’ll cost to protect your employees from getting hurt.

We can save you money

We work with over 30 insurance companies to get you affordable liability coverage at the right price. Just fill out a simple form about your business, and we’ll compare rates from top national companies for you at no extra charge. Get started now.