How much does business insurance cost?

Small business insurance can cost somewhere between $500 and $1,000 for many small businesses with few or no employees to get properly insured. That’s only around $41 to $83 per month. But it really depends on your situation. We have some sample prices based on industry and type of coverage, but it’s important to know that these are general estimates. A lot more things can affect the price of business insurance.

If you’re a small business owner you will obviously pay less for business insurance than a large corporation. The main reason is that you face less risk. The amount of risk you face is the main factor for how much your insurance will cost each year. As you grow, your needs will adapt and change. And it will likely cost more.

Median coverage costs

Here are some samples of the median costs our policyholders have paid in the last year by coverage.

General Liability: $51/month

Business Owners Policy (BOP): $69/month

Professional Liability: $43/month

Workers’ Comp: $71/month

Average coverage costs

Here are some samples of the average costs our policyholders have paid in the last year by coverage.

General Liability: $60/month

Business Owners Policy (BOP): $99/month

Professional Liability: $49/month

Workers’ Comp: $112/month

The cost depends on the type of policy you need. That’s because each type of policy covers you for a specific risk. And that’s factored into the price of the policy. But you also can’t expect to pay the median or average rate. Many factors play a role here. The biggest factors are your profession, number of employees, and coverage needs.

But there are other factors as well– such as having a claims history or needing higher coverage limits. Business insurance costs can also vary widely from business to business–even within the same industry. The best way to find out how much insurance will cost is to get a quote so that you can get the exact price you will pay.

We can help you get the right insurance at the lowest cost. Want to know how? We compare top insurers at no extra cost to you. Get started now.

Business insurance cost factors

It makes sense because the more money you make, the more you have to lose. And the more you have to lose, the more insurance coverage you need. In a nutshell, more revenue = more coverage = higher policy price.

However, a shop in an urban area might pay more for liability insurance. That’s because there is more foot traffic in their location compared with a country general store. More foot traffic brings more risk.

Additional insurance cost factors

Your Industry

Different professions face different risks. A bookkeeper faces much less physical risk than a construction worker. Therefore, workers’ comp is less expensive for bookkeepers than construction workers. However, a bookkeeper most likely handles more sensitive information than a construction worker, so their cyber liability policy would be more expensive.

If the bookkeeper works remotely, and doesn’t have much in-person interaction with clients, their general liability policy would be less expensive than a construction worker’s. That’s because contractors work on job sites and interact with clients’ property. Therefore, there is more risk of property damage and bodily injury.

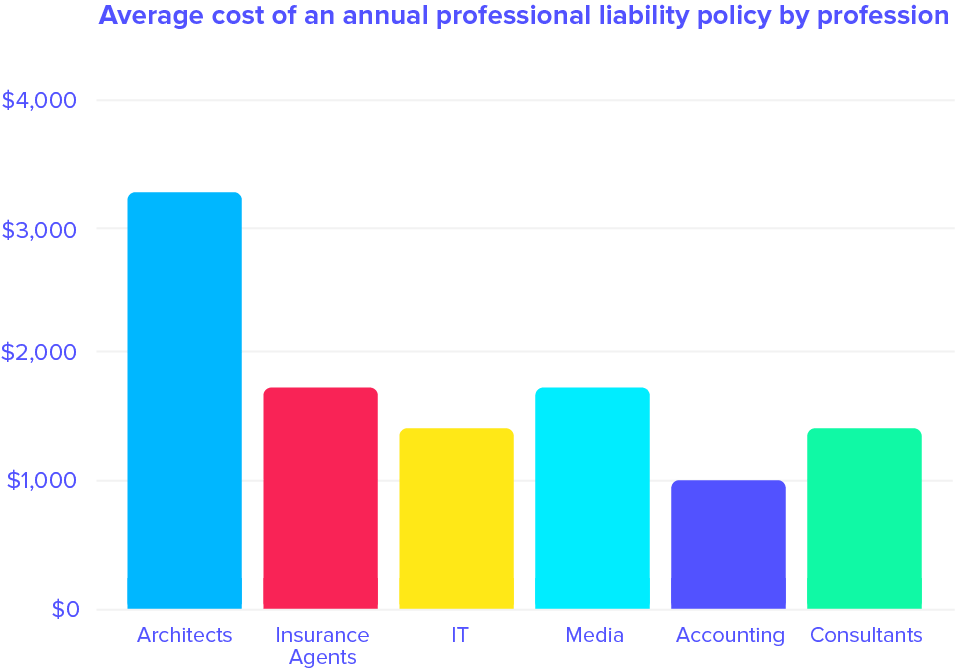

Consultants, architects, and engineers tend to have higher professional liability premiums than designers, writers, and small retailers because they provide expert advice and services. That’s because they’re more at risk for claims related to negligence and professional errors.

Claims History

Insurance companies will often raise the rate for the industry as a whole if many people have filed claims within the same field. So, let’s return to our bookkeeper and contractor example. More contractors have filed work-related illness or injury claims than bookkeepers. Therefore, the workers’ comp classification rate for someone in construction is higher than for a clerical worker.

However, if few claims have been filed in your industry, insurance companies may lower the rates based on good claims performance.

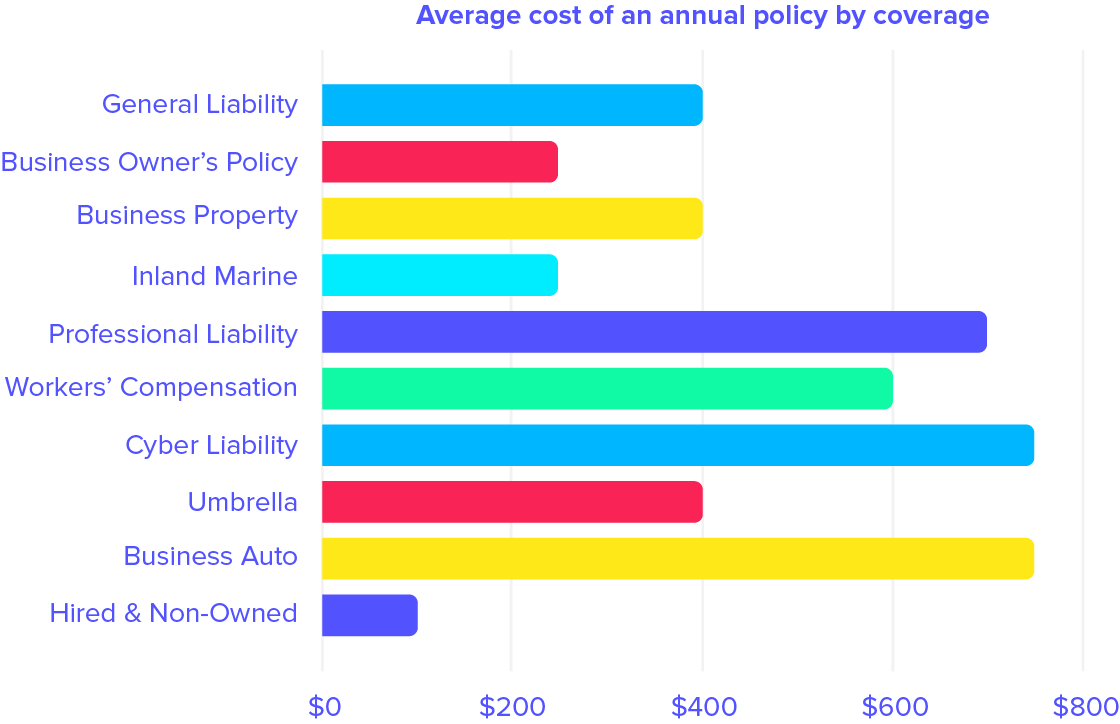

Cost by coverage

Prices Vary by Policy

Insurance rates depend on the level of risk the policy covers. Those considering liability insurance are looking to cover different liabilities than those getting workers’ comp. Higher risks means more potential for claims. That’s why some insurance is more expensive than others.

See the graph below to get a better understanding of how insurance rates vary by type.

General Liability

Liability insurance the first type of insurance most business owners will buy, because it provides great baseline protection. General liability insurance covers various mishaps, including physical claims like bodily injury or property damage, as well as non-physical risks such as copyright infringement, libel, slander, and false advertising. Court costs are also covered with this policy in the event that you face a lawsuit.

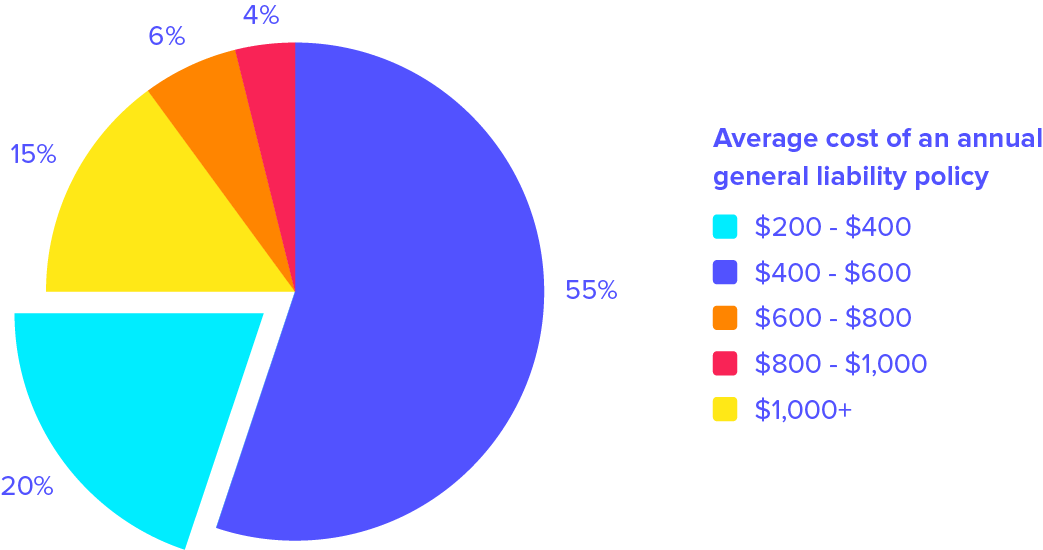

How much does general liability cost?

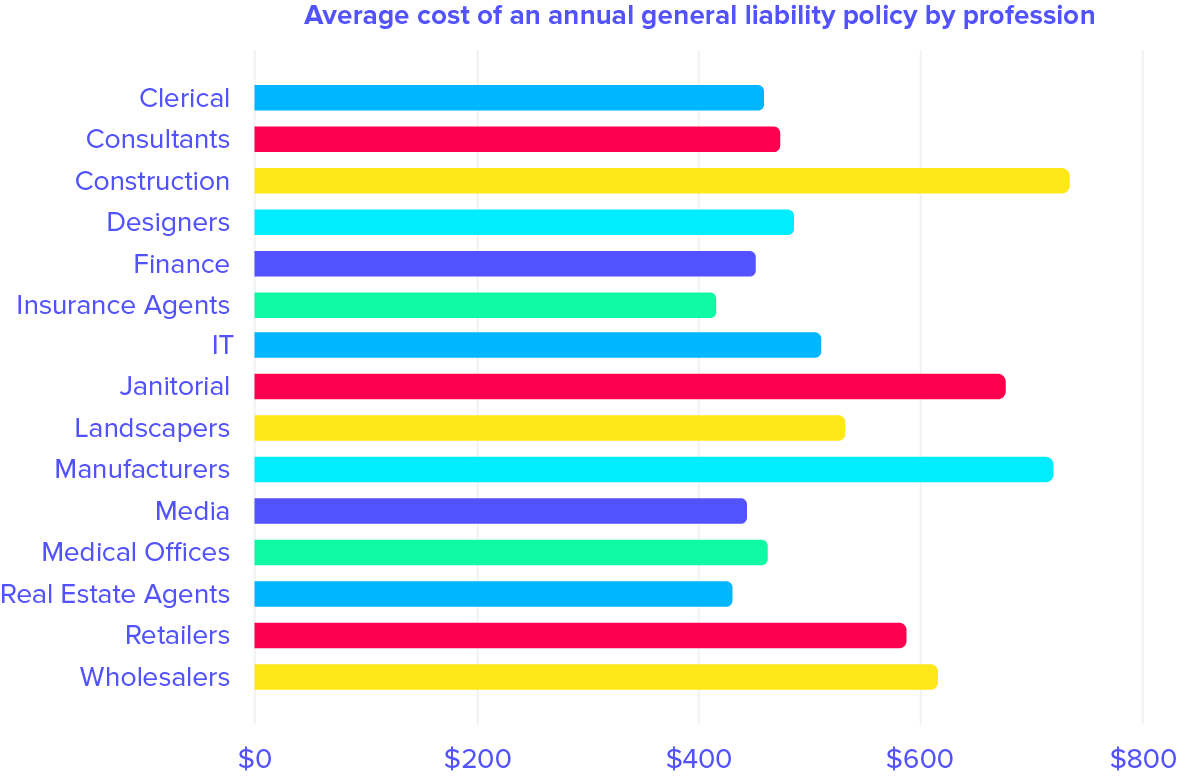

On average, small business owners with between 1–10 employees typically pay between $400 and $650 per year for a general liability policy. That comes to around $33 to $54 per month to get insured.

Things that can affect your GL cost:

- The location of your business

- If you meet with your clients in person

- If you represent clients

Learn more about general liability insurance costs .

Depending on your line of work, general liability insurance prices can vary. The more you engage with the public the more the policy will cost. That’s because GL covers third-party bodily injury (slips and falls) and property damage. The higher your risk for a claim the more your insurance will cost. Check out the average cost range by profession in the chart below.

Professional Liability

Professional liability (also known as errors and omissions or E&O) is important for anyone who provides expert advice or services to clients. It can be risky when people depend on your expertise. And you could face a lawsuit from an angry client at some point in your career.

Professional liability insurance covers negligence, failure to deliver promised services, professional errors, and court costs (should you face a lawsuit).

How much does professional liability cost?

Professional liability (e&o) protects you from claims that your business made an error or mistake in giving professional services. Many small operations can expect to pay between $600 and $1,800 per year. Although, the policy average is around $900 per year (or $75/month) for professional liability (i.e. errors and omissions).

Professional liability insurance cost factors:

- Your profession

- Business location

- Your size

- Your tendencies

- The number of claims your industry has filed

Your insurance cost will depend a lot on what you do. The insurance company will evaluate these risk factors when considering the price of your policy. The more exposure you have, the more it will cost.

Learn more about professional liability insurance costs.

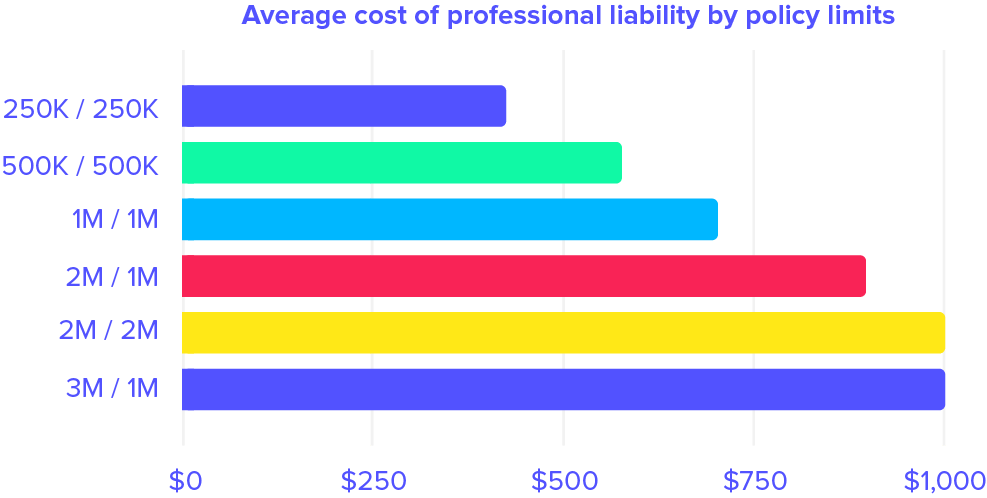

The level of limits you select for you policy affects the price of the coverage. The higher the limits, the more you will spend.

Commercial Property

Most professionals rely on some sort of device, tool, or piece of equipment to successfully complete their work. Commercial property insurance covers commercial property replacements or repairs in the event of a natural disaster, burglary, fire, or flood.

How much does commercial property insurance cost?

The price depends on the value of the items you would like to insure, but if you’re a modest operation, you could pay as little as $400 per year. That’s just $33 per month for property insurance. However, if you’re looking to cover high-value items, the price will increase.

Business property coverage includes:

- Tools

- Equipment

- Devices

- Furniture

- Supplies

- Inventory

- And more

Inland Marine

If you have commercial property insurance, that’s great! But the downside is that the coverage ends after you are 500 feet away from your premises.

To protect your commercial property off-premises, you’ll need inland marine insurance. If you take your tools, equipment, or supplies to client meetings and other job sites, this policy will protect your property in transit and at other locations.

How much does inland marine insurance cost?

The price depends on how much you need. For example, you could pay $250 for $10,000 worth of inland marine coverage, but it all depends on what you do, what you’re covering, and what the property is worth.

Business Owner’s Policy

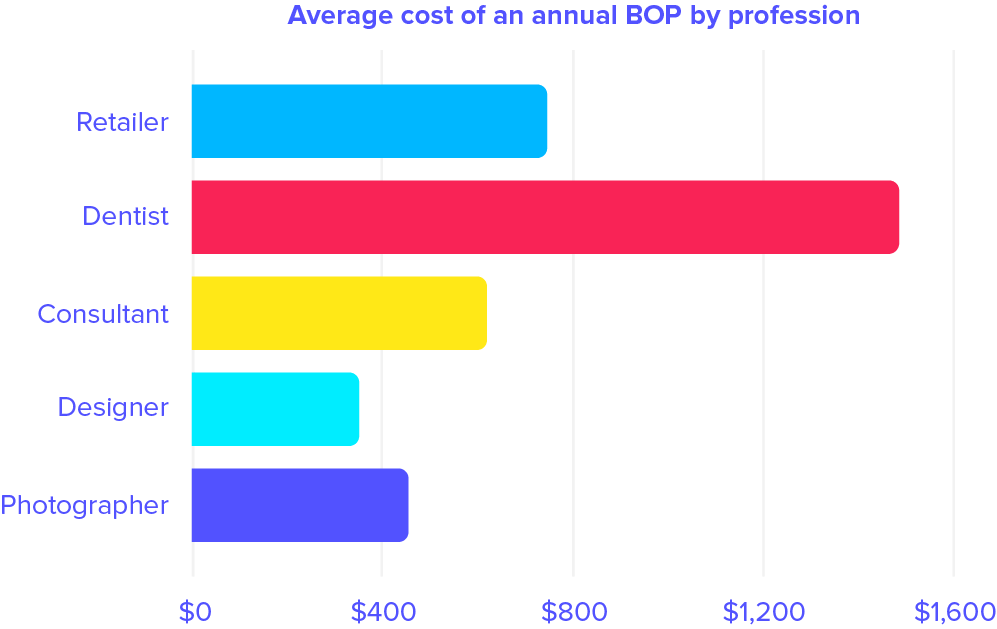

BOP insurance combines general liability and commercial property insurance at a discount. Business owner’s policies basically give you more coverage at a lower price than if you bought each policy separately. The great thing about BOPs is that it’s quite simple to tack on even more coverage. All in all, it’s a great way to reduce the cost of business insurance.

How much does a business owner’s policy cost?

The price of a BOP depends on the size of your business. If you’re a one-person operation, you could pay as little as $250 per year for a BOP. But some may pay around $1,000 per year, or $80 per month. It all depends on the risks you face and the amount of coverage you need.

BOP Cost factors include:

- Your claims history

- Number of employees

- Your revenue

- The worth of your business property

Learn more about BOP costs.

Workers’ Comp

Workers’ comp insurance covers you if an employee gets hurt on the job. Medical bills can add up, so it’s good to stay covered. Owners can also cover themselves.

How much does workers’ compensation cost?

Calculating workers’ comp rates is tough to do because each business is different. Workers’ comp is calculated by the following equation:

Other factors include the expense constant, which covers administrative fees. This averages around $200. If you are eligible for any premium discounts, it will affect the price as well.

Things that affect workers’ comp cost:

- Your profession

- Where you do business

- Your payroll

- Your claims history

Check out our workers’ comp insurance cost sheet to learn more.

Cyber Liability

Protect your business and your customers in the event of a cyber threat. If you handle any sensitive customer information, even something as simple as credit card information, you should consider this policy. In the event that your customers’ information is exposed, it is a very long, expensive road to remedy.

Cyber liability insurance helps you and your customers stay protected, and helps cover the costs of customer notifications, forensics investigations, credit monitoring, and more.

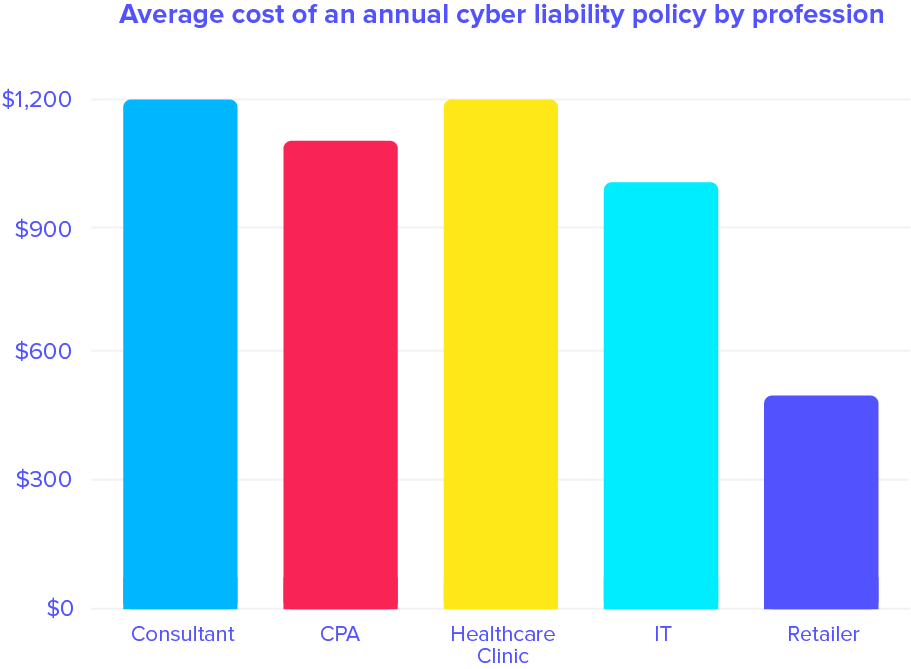

How much does cyber liability cost?

The price of the policy usually starts at around $750 for an annual policy. That’s just $63 per month. But it can go as high as $8,000 annually. The cost can increase based on the factors below.

Cost factors include:

- Your profession

- The types of information you gather

- How many transactions take place

- How many devices are involved

- Where you do business

- Revenue

Commercial Auto

If your business owns vehicles, you need this policy. Plain and simple. If you are driving a vehicle owned by your business and something happens, you’re probably out of luck. Many people don’t realize their personal auto policy typically will not cover the incident.

Protection benefits of commercial auto insurance include bodily injury liability, property damage liability, physical damage, and collision coverage.

How much does commercial auto insurance cost?

Generally speaking, the average cost per vehicle is around $750 per year. That’s just $62 per month.

Commercial auto cost factors:

- The vehicle make and model

- The age of the vehicle

- The cost of the vehicle when it was new

- The vehicle’s weight

- The user’s driving record

Hired & Non-Owned Auto

Hired & non-owned auto insurance is necessary if you hire, rent, or borrow vehicles for work. It also extends liability coverage to employees who use their personal vehicles on behalf of your business.

How much does hired & non-owned auto insurance cost?

This endorsement is very affordable, and can start from as little as $100 per year. That’s only $9 per month.

Umbrella Insurance

Umbrellas add extra protection to existing business insurance policies. So, if you have a commercial auto policy, but are looking for an added layer of padding, you can place an umbrella on top of your business auto policy.

Let’s say your auto insurance policy has limits of $500,000. You get in an accident while driving on behalf of your business, and the damages result in $600,000. While your commercial auto policy payout is capped at $500,000, your umbrella insurance can pay the remaining $100,000.

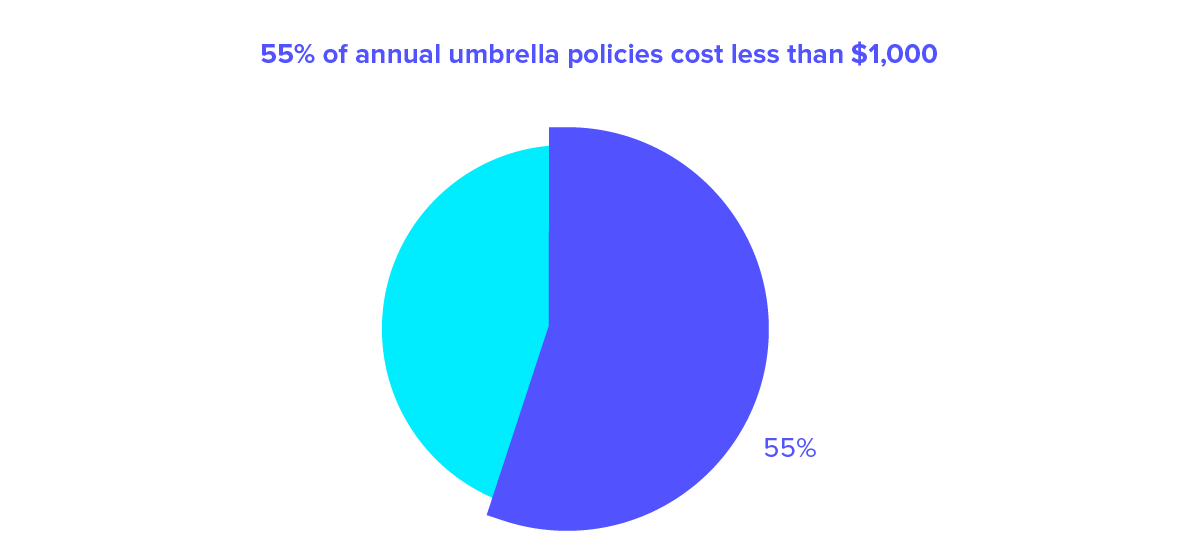

How much does umbrella insurance cost?

Depending on the limits you pick, you might pay between $400 to $600 per year for starters. That’s between $33 and $50 per month.

Save on business insurance costs

Shop Around

According to Fit Small Business, 40% of businesses will file a claim within a 10 year period. That makes it likely that your business insurance costs will pay off at some point.

But you can save some money now by shopping around at different insurance companies. Many times an insurance company has better deal for certain industries that they specialize in. An insurance expert can make sure you’re comparing apples to apples– and that’s where we can help. Just fill out one simple form about your business to compare insurance from over 30 top providers (at no extra cost).

Bundle for a better deal.

Many insurance companies will give you the option to package things together. And you can save money by doing so. A business owner’s policy is a popular option for low-risk businesses. They’ll give you a deal for combining GL and property insurance together.

Bonus: You can easily include more coverages and endorsements to the package based on your needs.

Check out more tips on saving money in our Cheap Business Insurance guide.

We can save you money.

We’ll compare quotes from over 30 insurance companies to get the lowest price for small business insurance. We offer free estimates from top insurers– with zero commitment. Get started now.