How much will business insurance cost?

The search for affordable insurance is something that most self-employed people experience at some point. The cost of self-employed commercial insurance depends on many factors, including the size of your business, where you work (like at home versus an office space), and the type of risks you face.

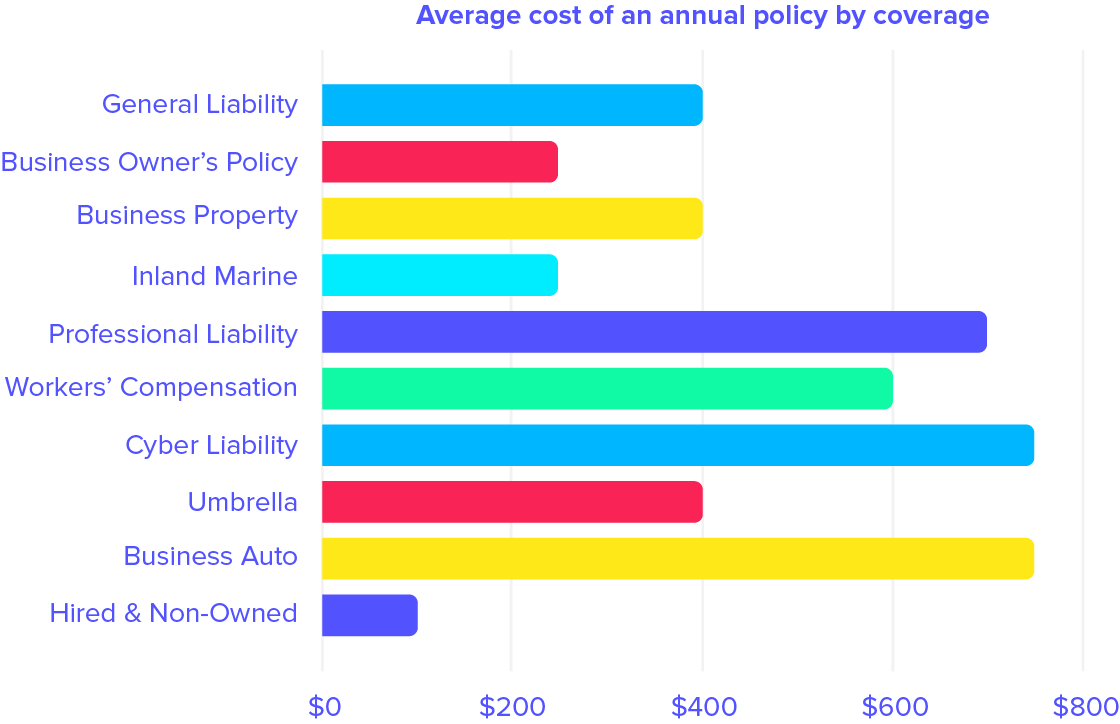

Rates vary by coverage

The graph below depicts the average price per insurance policy. Please remember that the following cost estimates are just a general price reference, and to understand the exact rates for your business, you’ll need to fill out a simple form to get a free estimate. We’ll compare quotes from over 30 top companies to find you the best coverage at the right price.

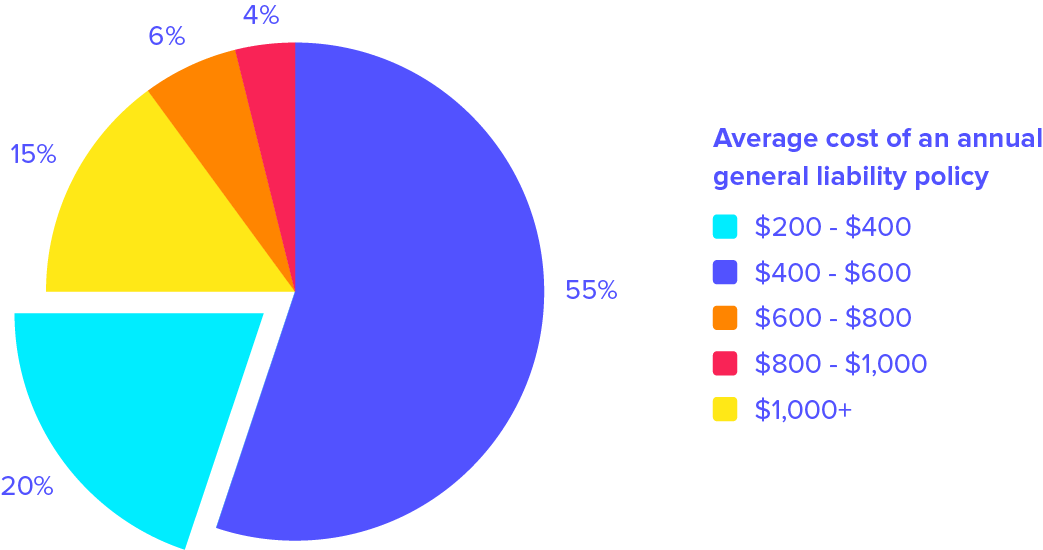

General liability costs for the self-employed

This type of insurance is a key baseline that all self-employed business owners should consider. It provides protection from bodily injury, property damage, libel, slander, copyright infringement, and more.

The majority of small business owners can typically expect to pay between $400 and $600 a year for liability insurance. Paying as little as $35 / month can be worth it in the long run — especially because many general liability claims can amount to over $10,000.

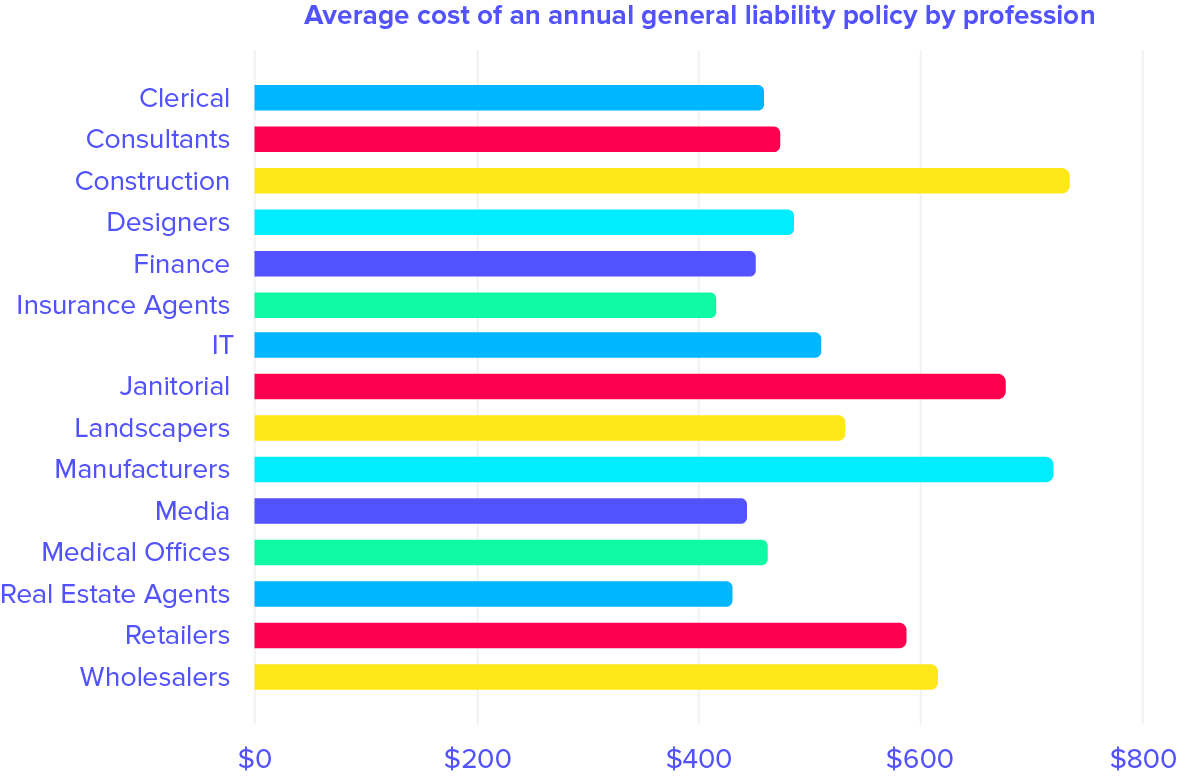

Depending on your line of work, general liability insurance prices can vary.

How much does commercial property insurance cost?

Self-employed people can’t do business without their work gear, whether it be laptops, tablets, camera equipment, or other high-value items. If your work property gets lost, damaged, or stolen, it can seriously impact your work (as well as your pocket).

Protecting your commercial items with business property insurance assures your equipment will be covered in the event of an incident. Your policy will pay for your gear to be repaired or replaced, depending on the damage.

Rather than pay upwards of $5,000 to replace your damaged camera, why not protect it with commercial property insurance? This policy can be as inexpensive as $400 / year. However, if you’re looking to insure more property or high-value items, you could pay around $750 for business property insurance.

Protecting your property of premises

If you take your work gear with you to meetings, shoots, or anywhere off your business premises, your commercial property insurance ends after you’re 500 feet away from your space. If you’re interested in protecting your property in transit and while at other locations, consider inland marine insurance.

The price of inland marine insurance depends on how much you would like to cover. As an example, if you’re looking to cover $10,000 worth of commercial property, your policy may cost around $250 / year.

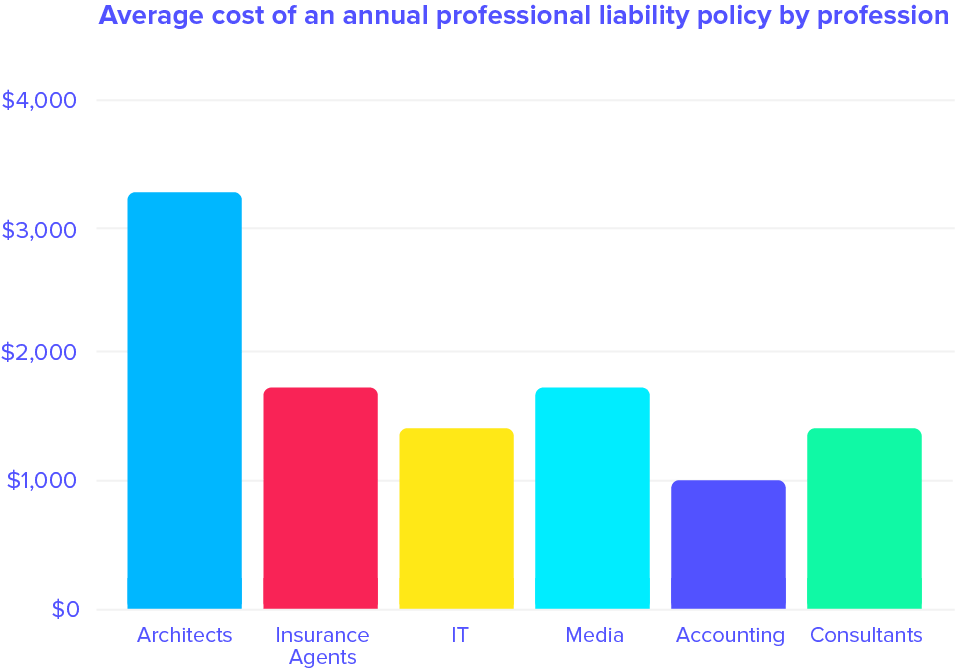

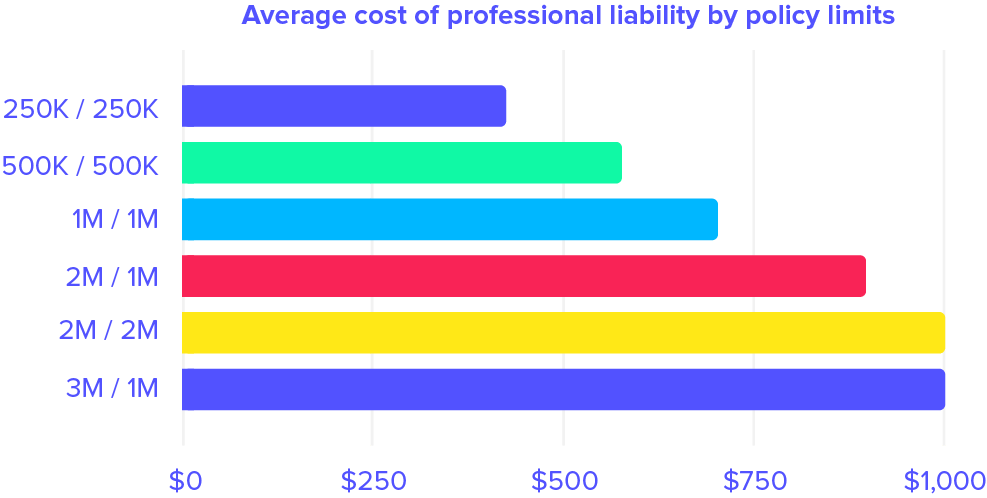

How much does professional liability cost?

Professional liability prices can vary depending on the level of risk associated with your profession. Most consultants, cosmetologists, and real estate agents are considered to be low-risk. Therefore, they might pay around $600 for a policy. If your industry has higher risks, like working in IT or the cyber world, your professional liability insurance costs could be higher.

Aside from what you do, another aspect that affects price includes where you operate your business. Insurance rates vary by state, and some states are more expensive than others.

A third element that can affect the cost of professional liability insurance is how many claims other people in your industry have filed. If others working in your field haven’t filed many claims, insurance providers will lower the price for your industry as a whole due to good performance.

Additionally, the level of limits you select for you policy affects the price of the coverage. The higher the limits, the more you will spend.

Workers comp for the self-employed

The cost of workers’ compensation insurance relies on a variety of factors, including where you perform you work, how many employees you have, and what you do for a living. The higher the risk, and the higher your payroll, the more expensive your insurance policy will be.

Rates are very specific and can vary greatly from business to business. The cost of this policy is calculated by the following equation:

Learn more about the cost of workers’ compensation insurance for the self-employed.

Self-employed cyber liability cost

What you do for a living affects the price of most policies, and cyber liability is no different. Prices depend on your line of work, the type of information you handle, how many transactions take place, the number of devices involved, and your location. And, of course, the size of your business and the liabilities you face.

For example, a small retail store could pay $500 for an annual policy, whereas a consultant might pay $1,200. Generally speaking, cyber liability insurance policies for the self-employed start at around $750 per year (depending on what limits of liability you select).

How much does business auto insurance cost?

If your business owns vehicles, having commercial auto insurance is a good idea. It’s a common misconception that your personal auto insurance covers business vehicles, but oftentimes it’s not the case. Commercial auto insurance rates for the self-employed average around $750 / year.

Note: If you hire, rent, or borrow vehicles for work, your business auto policy may not extend liability protection to those vehicles. The same is true for employees using their personal vehicles on behalf of your business. For these situations, hired & non-owned auto insurance comes in handy. It’s a very cheap endorsement that can be added onto your commercial auto policy for a mere $100 / year (give or take).

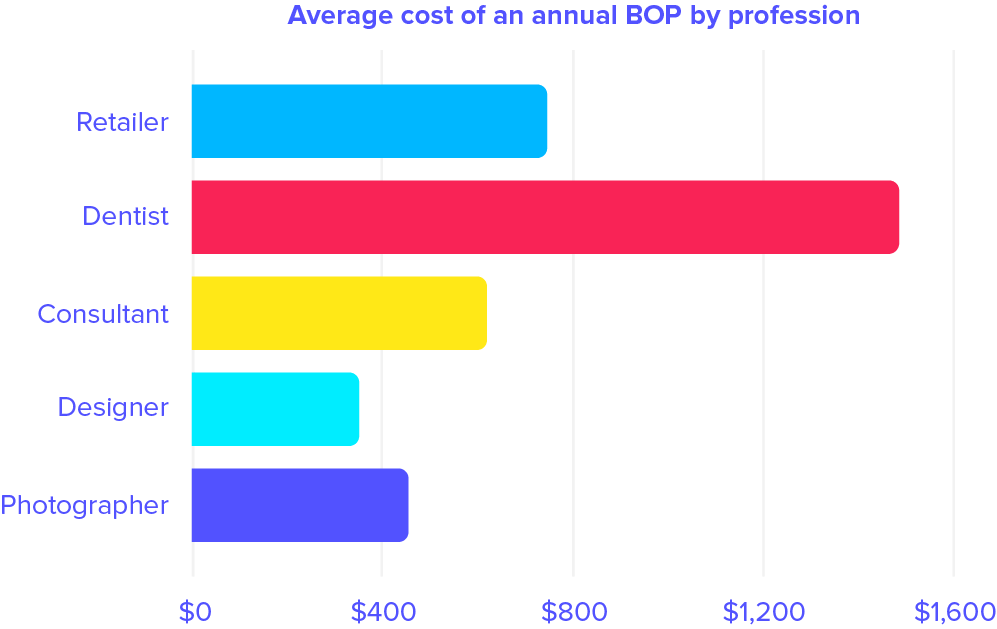

Cost-effective insurance options

If you’re looking for more coverage and a better deal, you might want to consider a business owner’s policy, or BOP. BOPs combine general liability and property insurance into a bundled deal. These policies can start from as little as $250, depending on what you do.

Note: If you work from your home, or keep your business equipment at home when you’re not working, don’t rely on your homeowners insurance to protect your commercial property. In the event of an incident, your homeowners policy may only cover up to $500 in business property damages. In order to stay protected, you’ll need inland marine insurance.

We can save you money.

Complete a quick online questionnaire about your business, and we’ll compare rates from over 30 insurance companies to get you the best coverage at the lowest price. We offer free estimates with zero commitment.