How much is professional liability insurance?

Also known as errors and omissions liability, or E&O insurance, professional liability protects you against unhappy clients. This policy helps those who provide professional goods or services, and comes in handy if you make a mistake or overlook something. The cost of professional liability / e&o insurance may be nothing compared to the price of getting sued one day. That’s the best way to think about it when you purchase a policy.

The median cost our policyholders paid for professional liability last year was about $420 per year. That’s just $35 per month. The average cost paid was about $588 per year, which is only $49 per month.

There is no cut-and-dried answer for the price of E&O insurance. But we can give you an idea of general price ranges. Please understand that these are just estimates and that the cost of professional liability is very specific to each business. The only way to figure out exactly how much your liability insurance will cost is to get a quote. We compare quotes from over 30 top insurance companies (for free). Get started now.

Professional liability cost factors

The cost depends greatly on what the services you provide each day. Below are some of the elements that can affect your liability insurance cost.

Your profession

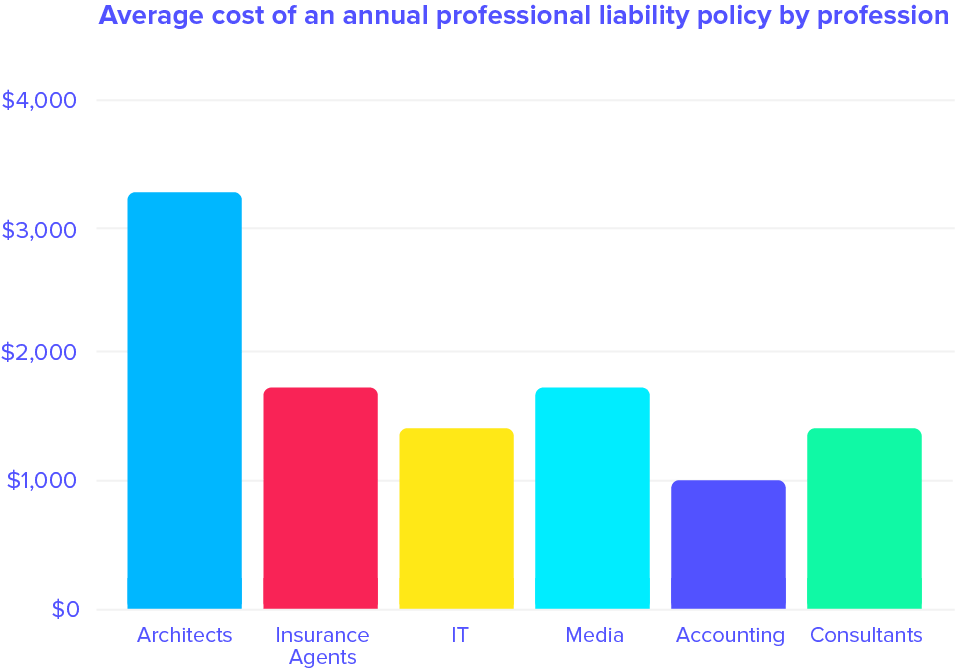

A big reason people purchase insurance is to manage their risk. It’s nearly impossible to have a cookie cutter insurance policy. That’s because all professions have different risks and liabilities. The more risk, the higher the cost of professional liability insurance.

Your location

The frequency (and cost) of industry lawsuits can vary by state, or even by zip code. Because court costs and lawyer’s fees are benefits of this policy, the cost can fluctuate by location.

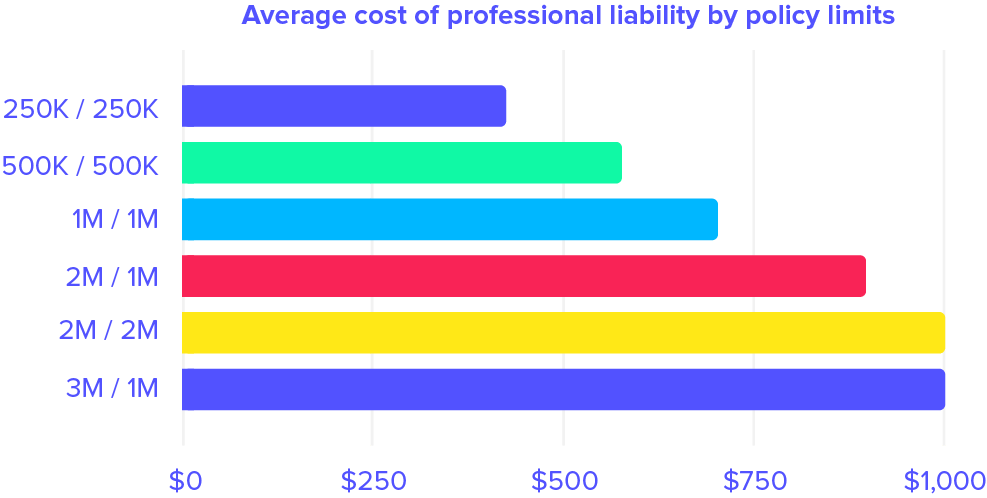

Your liability limits

The level of liability limits you select for you policy refers to the maximum price your insurance provider will pay for a claim. The higher your limits, the more expensive your policy will be. The graph below depicts popular professional liability limits.

Your size

Professional liability costs depend on the size of your operation, how many employees you have, and your annual revenue. The time you’ve been in business can also affect the cost.

Risk Exposure

You’ll pay more for protection if you offer high priced services or handle sensitive information. That’s because there’s more risk for a costly claim.

Your tendencies

If you hire experienced workers, and provide them with good training, it can help your chances of getting a cheaper E&O policy. The same is true when it comes to working with well-written contracts. And, of course, avoiding lawsuits.

Number of industry claims

If there are a high number of claims filed in your field, insurance companies will raise the price for the industry. However, if there are few claims, insurance companies will lower prices.

Coverage needs

An insurance policy with a $1 million / $2 million dollar limit will likely cost more than a policy with a $1 million / $ 1 million limit.

Average cost by profession

Many small businesses can expect to pay somewhere between $350 and $1,800 per year for professional liability insurance. That’s between $29 and $150 per month. Many of our policyholders are in the $400 range for a year’s worth of professional liability coverage.

If you are considered low-risk (like a one-person operation working as a consultant or hairdresser), the cost of your policy will be less expensive than someone who faces more risk, like an IT professional. Smaller businesses can expect to pay around $80 per month for up to $2 million dollars in coverage.

$80 per month may not sound like an enticing investment, but according to the Small Business Administration, 53% of small businesses are involved in at least one lawsuit at any given time. Professional liability will protect you if a client claims you made a professional mistake, were negligent, or failed to deliver promised services. $80 doesn’t seem too bad if you think of the costs involved in a lawsuit.

Event policies vs. annual policies

Event policy

These short-term policies are something you might purchase if you are hosting an event, like a conference or fundraiser. Event-based policies might seem cheaper up front, but they can really add up. If you think you might be working on more than one or two events a year, consider purchasing an annual policy — it could end up saving you money in the long run.

Annual policy

If you’re not getting a short-term policy for an event, the only other way to get professional liability is to purchase an annual policy.

If a client requires you to have your own insurance for a specific gig, it’s not recommended to cancel the policy after the gig is over. Firstly, there’s no benefit to cancel, because it’s not going to save you money. Even if you have the policy for a month-long project and cancel it afterwards, you’re still paying the price for a yearly E&O policy.

Secondly, if you keep stopping and starting policies, your insurance provider will most likely raise your rates. This is because they may think you’ve been working without coverage. You could be seen as a higher risk than someone who has been continuously insured while working.

How to save money on errors and omissions

Understanding how insurance deductibles work

By definition, a deductible is the amount of money you pay for a claim before your insurance kicks in. Let’s say your deductible is $1,000. You face a client lawsuit, which amounts to $8,000. To handle the claim, you would pay the first $1,000, and your insurance provider would pay the remaining balance.

Deductibles often vary based on the size of your operation. Typically, the larger the company, the higher the deductible. That’s because a larger operation can absorb more of the sharing of risk (and therefore, cost).

The higher your deductible, the lower your premium.

Insurance providers will give you a discounted rate if you’re willing to take more of a risk upfront. So, if you bump up your E&O deductible from $500 to $1,000, you’ll save on a percentage of your premium.

Although most small businesses have deductibles that hover around $500–$1,000, there is a lot of flexibility when it comes to setting the price. Just remember, the lower your deductible, the more your policy will cost.

Minimize risk

Insurance companies provide insurance to manage risk, which you probably already know by now. But what you might not be aware of is that they will oftentimes reward policyholders for sharing risk, or working towards minimizing their risk.

There are several ways to minimize your risk. Firstly, require outside contractors to have their own insurance policy, and ask to be listed on their policy as an additional insured. That way, if something happens, you’re not exposed. Instead of relying on your coverage, you’ll be able to benefit from theirs.

Another way to minimize your risk, and ultimately your bill, is to avoid hiring uninsured subcontractors. If something happens to them while they are working for you, they can file a claim against you and your insurance. Filing claims impacts the cost of your policy, so be sure to ask subcontractors carry their own insurance policy. That way they can’t rely on yours.

Additional Business Insurance Costs

Want to know how much it’ll cost to insure your business? Take a look at our in-depth breakdowns of each business coverage cost.

- Business Insurance Cost: A breakdown of all types of small business insurance costs. See what many small businesses pay each year.

- Workers’ Comp Cost: This guide will help if you want to see how much it’ll cost to protect your employees from getting hurt.

- General Liability Insurance Cost: General liability is one of the most comprehensive coverages for the average small business. Check out what it might cost you.

- BOP Cost: You can save money by getting coverages bundled together. A business owner’s policy is a great way to do that– here’s what it’ll cost you.

Want to find low-cost professional liability insurance?

Complete a free online application with us in 10 minutes or less. With a single form, we compare professional liability rates with over 30 insurance providers to get you the best coverage at the right price. All estimates and advice are free.