How much does BOP insurance cost?

A business owner’s policy, or BOP, is designed for small businesses in low-risk industries. A business owner’s policy is a packaged commercial insurance policy that combines general liability and business property insurance. BOP insurance costs can range depending on your industry and unique situation.

The great thing about this bundled deal is that it provides coverage that small businesses need for less money than the price of purchasing each policy separately.

What affects the price of a business owner’s policy?

Your claims history, number of employees, revenue and the amount of property you need to protect are all major factors in the price of a BOP.

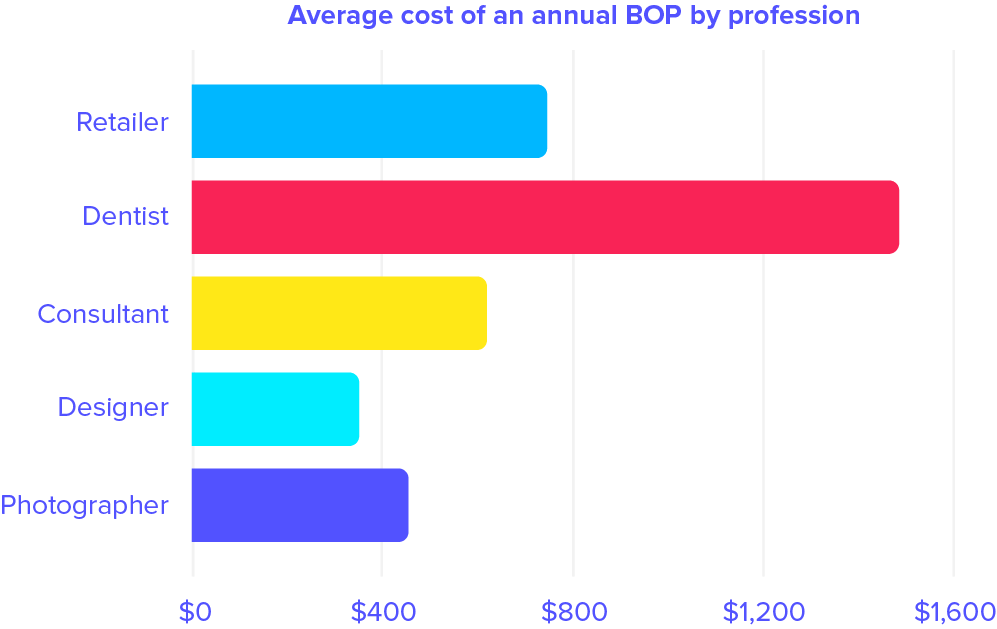

The price of BOPs also varies based on what you do and where you do it. Rates and requirements differ based on each state, which affects the price of your policy. Prices also vary by industry, as some professions face more risk or require more protection than others.

Because every insurance carrier has their area of expertise, the business owner’s policy rates can fluctuate based on the provider’s specialty.

We’ve put together some sample prices of business owner’s policies, but it’s important to remember that the costs of business owner’s policies vary a lot depending on factors that are specific to each business. That’s why the best way to find out how much insurance will cost your business is to fill out a simple form about your business and get a free BOP quote.

BOP coverages at reduced costs

BOPs include vital coverage that every small business needs. These are the two main coverages you can save money on with a BOP:

General liability insurance

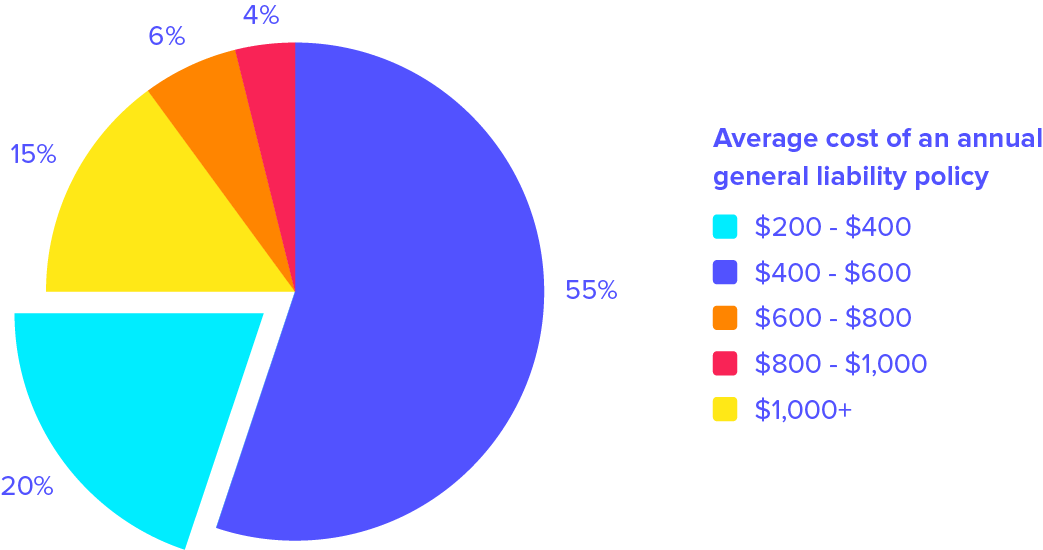

This policy is a great baseline for all small businesses to have. General liability insurance provides entrepreneurs, contractors, and small business owners with liability coverage from claims involving property damage, bodily injury, personal and advertising injury. Medical costs and defense costs are also included.

A standalone general liability policy averages around $500 / year for low-risk operations. However, with a BOP, the price can be less expensive than a typical policy, even with added property protection.

Check out our general liability insurance cost analysis to learn more.

Commercial property insurance

The price of this coverage varies based on what you do for a living, and where you do it. Another aspect includes what kind of commercial property you would like to cover, and how much of it.

Business property insurance covers equipment, supplies, inventory, and your office location itself. The policy protects your property against natural disasters, fires, theft, and vandalism, among other things.

The majority of smaller operations pay under $1,000 for an annual policy, with an average of around $500. With a BOP, you will have the property coverage combined with general liability, but without the higher price tag.

Average price of BOP insurance

The price of a business owner’s policy varies according to a multitude of underwriting factors as well as the addition of optional coverages. However, a small business owner can typically estimate paying somewhere between $500 and $3,500 per year, and many can expect to pay around $1,000 / year.

BOP minimum premiums

A minimum premium is the absolute lowest price available to pay for a policy. Every insurance provider has a set minimum premium. Low-risk professions have prices that are nearest to the minimum premium, while larger operations with more risk and commercial property have higher premiums. A BOP minimum premium heavily depends on where your business is located and what coverage is needed.

Many of the insurance companies we work with have minimum premiums that range from $250 to $500 per year for a business owner’s policy.

BOP endorsement costs

Business owner’s policies are great for small businesses because you can easily build them out to be a more robust policy specific to your needs. They’re very easy to customize while maintaining a lower price point.

Including additional coverages, referred to as endorsements, with your BOP will affect the price of your policy. Each endorsement that you add to your policy will increase the price.

Endorsement costs will vary with the insurance provider.

The rates are either a flat premium, or a percentage of the BOP premium itself. Fill out a form about your business, and one of our experts will help tailor the perfect business owner’s policy for you.

Prices for some endorsements, like money and securities or business interruption, are based on the limits for each particular coverage.

Additional Business Insurance Costs

Are you curious how much it’ll cost to insure your small business? We’ve put together a few cost breakdowns to help with that.

- Business Insurance Cost: A cost breakdown of common small business insurance policies.

- General Liability Insurance Cost: If you decide you don’t want the property insurance that comes with a BOP, you can get a standalone general liability policy. See what it might cost you.

- Professional Liability Cost: If you offer professional services, you might want to see how much it’ll cost to get errors and omissions insurance.

- Workers’ Comp Cost: Check out how much it might cost to protect your employees from getting hurt.

We can save you money.

Fill out a free quote in 10 minutes. We compare rates from over 30 insurance providers to get you the best coverage at the right price.