How much is a workers’ comp policy?

A lot factors determine what your workers’ compensation insurance costs will be. Here is an overview as to what factors affect the price.

Price factors

Where you live and where you work

Workers’ comp insurance is a state-regulated coverage. Because all states have different rules and requirements, the prices for this policy vary.

Depending on your state, you can exclude yourself from coverage, which would result in a less expensive policy. Other states mandate you have workers’ compensation for yourself, even if you have no employees.

Some insurance companies use a predictive modeling method to calculate the cost. With this model, prices depend on the claims history of a specific area. Zip codes that have had more claims in the past have higher insurance rates, while zip codes with fewer claims have lower rates.

What you do

Industries that face higher risks, like roofing and logging, tend to have more expensive policies than handymen and plumbers. The reason insurance companies assign more expensive rates to high-risk industries is because there are more claims, and the severity of the claims increases with the level of risk associated with the industry.

How workers’ comp rates are set

As stated above, all rates are state-specific. Not only that, every state assigns each industry their own rate as well. Industry rates depend on the level of risk involved with the work being performed, as well as the industry’s claims history.

For example, a clerical office employee surely is less likely to have a claim than an electrician. That’s why the workers’ comp rate for clerical workers is lower than for electricians. For example, in Virginia the rate for clerical workers is only $0.09, while the rate for electricians is $2.36.

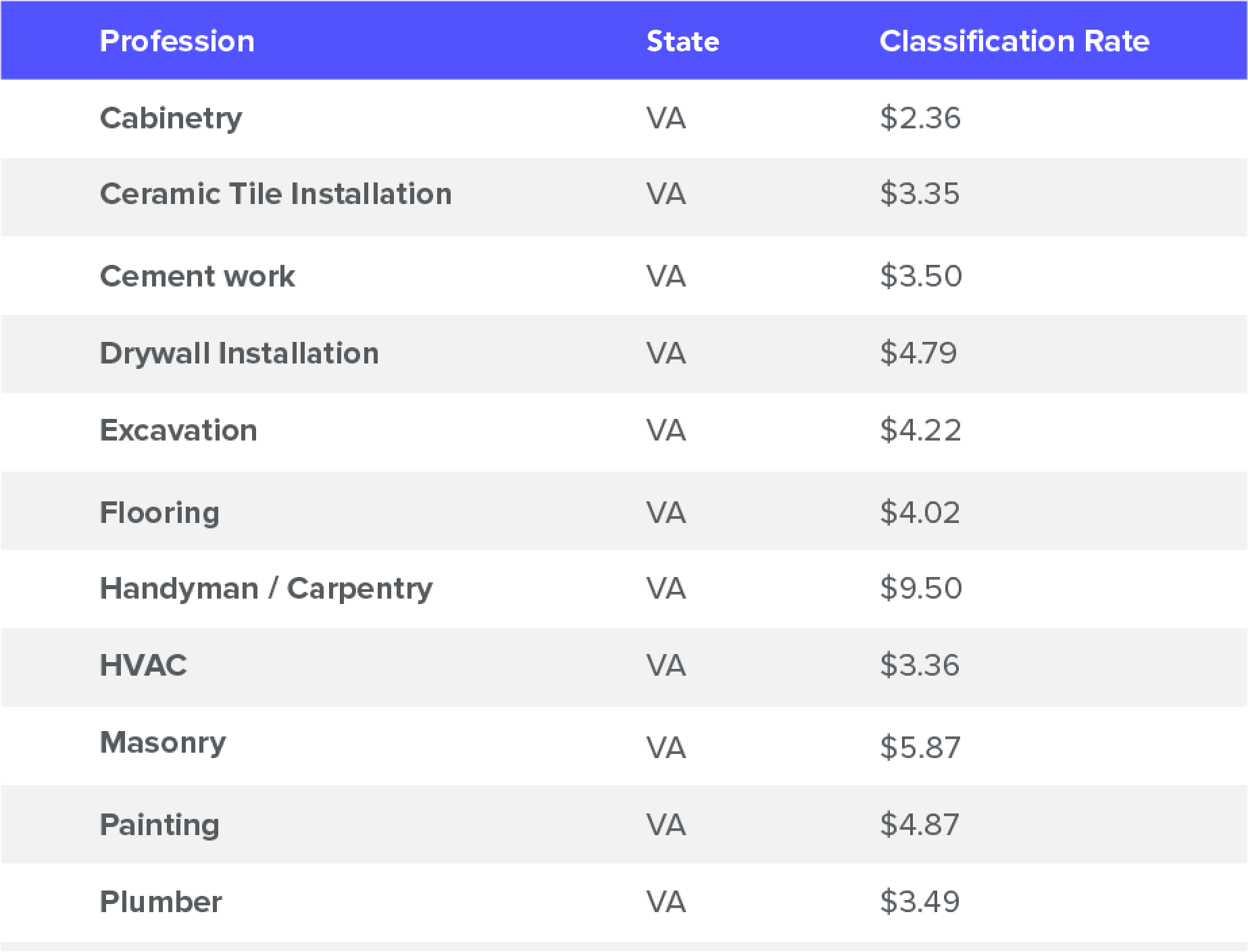

Below is a chart depicting assigned classification rates for independent contractors.

Here, we will use Virginia’s 2018 rates as an example. Remember, numbers vary by state.

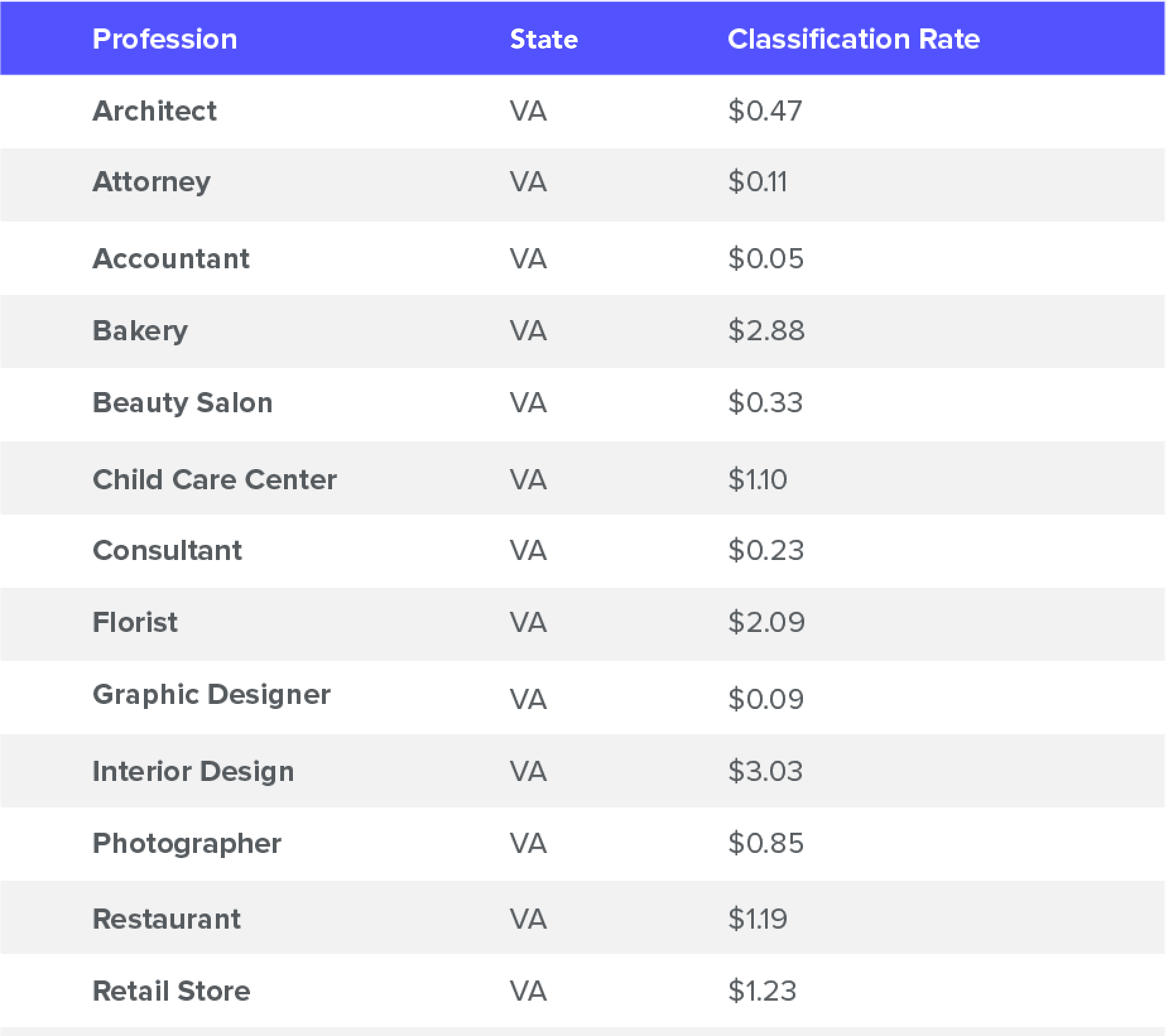

The next chart displays the classification rates for a variety of other professions.

These rates come into play when factoring your payroll, which we will discuss next.

Number of employees

Workers’ compensation premiums rely on payroll.

The price of this policy is calculated per $100 of payroll. So, if you have $15,000 worth of payroll, your “payroll per $100” would amount to $150.

Next, you would multiply the “payroll per $100” by your classification code rate. So, if you’re an electrician, you’d multiply $150 by $2.36.

This amounts to $354.

Now, there’s one more element that affects the price of workers’ compensation insurance.

Your experience modifier

Although this sounds like a wild night out or a crazy new video game, an experience mod, or mod, is basically just like a report card. Mods reflect your history, and are higher or lower depending on whether you have had any claims in the past.

Basically, mods compare your losses with everyone else in your industry within your operating states. If you perform better than your peers, you get a lower mod.

If you have had average performance, your mod will typically be 1.00. But if you have a history of claims, your experience mod will be higher. The reason you want a lower mod is because if it’s below 1.00, you will have a “credit mod”*, which means that your premium will be reduced.

*This credit only applies to those who have had workers’ compensation coverage for three years, or who have reached a certain payment threshold.

Alternatively, if you’ve had multiple losses, your experience mod could increase to 2.0 or above. This would lead to a higher workers’ comp rate, because as you’ll see below, your rate is multiplied by your mod. So, if you have a 1.00 mod, the price difference is null. But if your mod is 2.00, the price of your workers’ compensation insurance will be twice as expensive.

It’s a good idea to make sure you’re complying with every possible safety measure you can. It pays to stay safe and keep your costs down.

How are workers’ comp costs calculated?

Now that you have an understanding of what factors affect the cost of a workers’ compensation policy, we can put the whole calculation together.

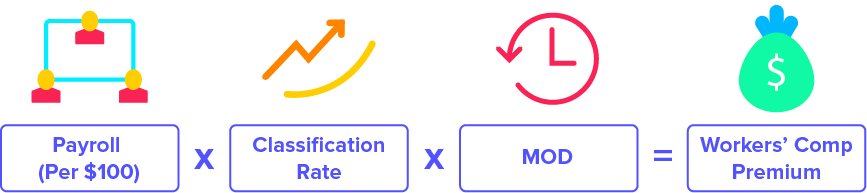

The cost of workers’ compensation is calculated by the following equation:

An additional factor includes the expense constant, which covers administrative fees. This tends to cost around $200. Also, any applicable premium discounts will factor into the price.

Low-cost workers’ compensation insurance

If you are required to carry workers’ compensation insurance by an employer, but do not need coverage, you may be eligible for a minimum premium workers’ comp policy. These policies are for people with no employees and who do not use subcontractors.

A minimum premium workers’ comp policy is a very affordable option to satisfy your proof of insurance requirements.

Check out some other ways you can get cheap and affordable workers’ comp.

Additional Business Insurance Costs:

Want to know how much it’ll cost to insure your business? Take a look at our in-depth breakdowns of each business coverage cost.

- Business Insurance Cost: Check out our breakdown of small business insurance costs to see what many small businesses pay each year.

- General Liability Insurance Cost: General liability is a basic catch-all policy for small businesses. Check out what it might cost you.

- BOP Cost: A business owner’s policy is a great way to save a little money by bundling coverages– here’s what it’ll cost you.

- Professional Liability Cost: Want to see how much it’ll cost you for errors and omissions insurance? This coverage is important if you offer professional services.

We can save you money

If your eyes are glazing over and your head is starting to spin, don’t worry. Just fill out a quick quote with us, and we can give you a free workers’ compensation estimate.

Our workers’ comp specialists have over 30 years of experience, and compare prices from top insurance companies to get you the best rates.