What is accident coverage?

Accident insurance provides you 24/7 protection on or off the job. Regardless of whether or not your have health insurance, this policy helps pay medical and non-medical expenses that result from an accident. Accident insurance stays with you — so even if you change jobs, your policy remains the same.

Do I need accident insurance?

When you think about getting hurt, two insurance coverages often come to mind: Health insurance and workers’ comp. But if you have one, and not the other, it can be Catch-22.

If you get injured on the job, your health insurance may not pay the medical bills. Let’s say you’re an exterior painter and fall off of your scaffolding. You fracture your back. In order to be compensated for a work-related injury, you would need a workers’ comp policy.

The reverse is also true: If you do have workers’ comp, but end up tripping on the sidewalk and fracturing your ankle outside of work, your workers’ comp policy would not pay. You would need health insurance to cover a personal medical expense. The National Safety Council estimates that two-thirds of accidents happen off the job.

Accident coverage closes this gap.

Why do I need accident insurance?

Accident insurance is crucial, because life is full of surprises. You never know what’s going to happen, or when it will happen. Even the most cautious aren’t immune from accidents. In fact, 4 out of 10 people have emergency room visits each year. And because the average hospital stay is 6 days, patients end up paying around $10,000 for their visit. Yikes!

While this policy does cover medical expenses, it is not a substitute for health insurance. But it is a very good option if you’re looking for some coverage, rather than none. Unlike health insurance, your benefits are being paid directly to you, instead of your health provider. That way, you can allot the funds in the best way you see fit.

A few other nice elements include immediate coverage — no waiting period. You don’t have to wait for open enrollment, either.

What do accident policies cover?

The benefits cover a variety of expenses, including:

- Out of pocket medical costs

- Deductibles and copayments on your medical insurance

- Monthly expenses, like mortgage or rent, car payments, utility bills, and more

- Basic needs like childcare, transportation, groceries, and home maintenance

- Hospital admission

- ICU admission

- Emergency room

- Initial doctor’s office visit

- Urgent care

- Ambulance

- Concussion

How much does accident coverage cost?

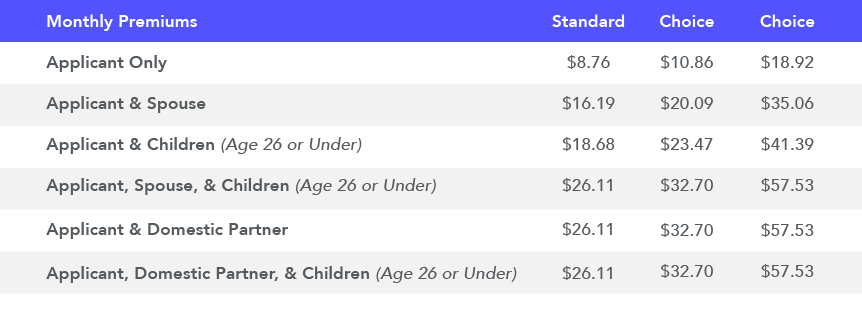

The monthly premium is based on who you want to cover and the level of coverage you choose. Want the protection for a few months? Great. Don’t need it for the rest of the year? You don’t have to pay for it.

Payments are easy and you can pay directly to our carrier using their autocheck drafting. The premium never changes and it’s guaranteed renewable for life. Even if you do have health insurance, there are many providers who are out-of-network, causing you to pay out of pocket for many visits and procedures. Accident policies can help you with these costs.

I Need a Certificate of Insurance. How can I get one?

If you are required to show proof of insurance, an accident policy will not suffice. In order to have a Certificate of Insurance, or COI, you will need workers’ compensation insurance.

Many hiring parties require independent contractors to have a COI so that the liability is taken off of themselves. By requiring you to have your own proof of insurance, they will no longer be responsible if something happens.

Workers’ comp & accident policy bundle

Our unique product Solo X, packages a minimum premium workers’ comp policy with an accident policy. Solo X is very affordable and is available to businesses with no employees, which is a great fit for many independent contractors. The owner is excluded from coverage, but because the bundle includes an accident policy, the owner will have 24-hour accident protection.

A minimum premium workers’ comp policy, also known as a ghost policy, is the most affordable type of workers’ compensation insurance on the market. Workers’ comp rates are based on payroll, and because this program is for business owners with no employees, that means there is no payroll. Therefore, you are paying the minimum rate possible for a workers’ comp policy.

Solo X is different from other ghost policies because it includes the bonus accident policy. With us, you get more coverage, and at a very affordable price.

How much is a minimum premium workers’ comp policy?

As stated above, payroll is not a factor in calculating a ghost policy rate. But where you live, and the industry you work in, definitely impacts the cost. For example, if you’re a landscaper you typically face less risk than an arborist. Because of this, ghost policy prices are more affordable for a landscaper than for an arborist.

To give you an idea on cost, many artisan contractors can expect to pay around $750 for an annual minimum premium workers’ compensation policy.

We can save you money.

Whether you are looking to purchase a stand-alone accident policy, or one packaged with a ghost policy, we’ve got great coverage at the right price. For a free estimate, get a quick online quote.