Do I need workers’ comp if I am self-employed?

When you work for yourself, you’re in charge of getting your own workers’ comp insurance.

Workers’ compensation is required by law in most states for businesses that have W2 employees. If you’re self-employed with no employees, you’re most likely legally exempt from purchasing workers’ compensation.

However, you might want to consider getting a workers’ compensation quote, even if you’re not legally required.

What is workers’ compensation?

Most states have put workers’ compensation requirements in place to protect both employers and employees, ensuring injured workers get the medical care and benefits necessary when hurt on the job. So, where does that leave people who work for themselves?

While working for an employer has its downsides (like office “huddles”, cubes, and dress codes), it also has its perks, like benefits. Working for yourself doesn’t come with the same benefits as a salaried employee working for a company, especially when it comes to insurance.

But that doesn’t mean you can’t get the same protection, which is why we offer workers’ compensation policies for self-employed workers.

What does workers’ comp cover?

- Medical costs due to sickness or injury

- Services needed to help recover and return to work

- Reimbursement for lost wages

- Protection from employee lawsuits (for medical expenses and lost wages)

Why do I need workers’ compensation insurance?

Most health insurance plans won’t pay for work-related injuries and illnesses.

If they do, the compensation is minimal, so be sure to check your policy. While you may have some coverage, keep in mind there will still be deductibles and copayments. With a workers’ comp policy, that’s not the case.

Just opt to include yourself in the policy and you will be set.

You may be required to have your own workers’ compensation insurance.

Regardless of state laws, some contract work requires that you carry your own workers’ comp policy. This is especially true in high-risk industries, like construction.

If you’re a contractor, read this: Workers’ Compensation for Independent Contractors.

What if I don’t have any employees?

Depending on what you do, workers’ compensation might be a good idea to get for yourself. If you get hurt on the job and find yourself out of work for several weeks, would you and your business be able to stay afloat?

Workers’ compensation can help pay medical expenses and lost wages while you are out of work.

Read more about workers’ compensation when you have no employees.

What if I hire subcontractors instead of employees? Do I need to cover them?

Depending on where you live, you may be legally exempt from covering contractors. Today, more and more states require you to carry workers’ compensation, regardless of whether you have full-time or temporary workers.

But it doesn’t matter whether you’re legally required to cover subcontractors or not: You can be held liable for anyone who gets hurt while working for you, whether you have insurance coverage or not.

How much does workers’ compensation insurance cost?

The cost of workers’ comp for the self-employed depends on several elements. Where you work, what you do, and the number of employees you have are primary factors that will impact the price of your workers’ compensation policy.

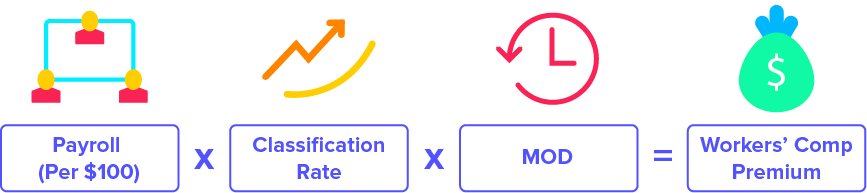

Industries that face higher risk have higher workers’ comp rates. Workers with greater payroll also have greater prices. The cost of workers’ compensation insurance is calculated by the following equation:

We can save you money

We compare prices from over 30 insurance providers to get you the best coverage at the right price. We provide free estimates with zero commitment.

Still on the fence?

We get it, you’re autonomous! You chose to work for yourself for a reason. Still, you might want to weigh out how much risk you actually face. Is your job physical? Do you use your car for work? Does your health insurance cover you for job-related injuries? Fill out a simple form about your business to get an online quote– it never hurts!