How much does business insurance cost for a handyman business?

As a handyman, it’s your job to make things better. You fix things that are broken and make them work, which is no easy job. Handyman work comes with risk. And with risk, comes liability.

To protect yourself from the risks of doing business, it’ll cost you some money. There are several affordable handyman insurance policies you’ll need, such as general liability, commercial property, contractor package policies, and workers’ compensation.

Below are some sample estimates to give you a general idea of what these types of insurance may cost. But keep in mind that the price of commercial insurance varies widely. The only accurate way to figure out how much insurance will cost you is to fill out a form about your business for a free insurance quote. We compare over 30 companies to find you the most affordable rates, with just one form, and we do it for free.

What is the cost of general liability insurance for a handyman?

Luckily, general liability insurance can offer a good amount of coverage without a massive price tag. Handymen should always have general liability insurance because it provides protection against bodily injury and property damage that happen as a result of your operations.

Several factors affect the price of a general liability policy, including where you live. The rates aren’t all the same because not all states have the same rules and requirements. Rates can also vary by zip code within a state. Rates can also differ between urban and rural areas, even for the same industry.

Another element that affects price is your level of interaction with the public. Handymen work at clients’ homes and offices, among other properties. Because you visit these types of job sites and typically deal with your clients in person, you have a higher premises liability exposure. This means that you face more risk with regard to bodily injury and property damage. The more exposure you have to risks like these, the higher the price of your general liability policy.

General liability policies for handymen typically average around $575 for the year for a small operation. However, policies can be as little as $350.

Commercial property insurance costs

Handyman businesses depend on many types of equipment to get the job done. As a jack-of-all-trades, you probably use numerous types of tools for the projects you work on.

And power equipment and tools aren’t cheap – they’re an investment. If one of the instruments you depend on gets damaged or stolen, you might not be able to complete the job you’re working on, which could affect your business as well as your paycheck.

Commercial property insurance, or contractor’s equipment insurance, provides protection for damaged, stolen, or vandalized items. This policy also covers damages caused by disasters such as wind, fire, or a burst pipe.

The price of most business property policies depends on your line of work, where you’re located, the property you want to cover, and what your property is worth.

Replacement cost vs. actual cash value

There are two plans available with commercial property insurance. You can choose how you want to be reimbursed for your losses – replacement cost or actual cash value.

Replacement Cost: This refers to the amount of money necessary to rebuild, replace, or repair an item based on its current worth. This plan is more expensive than actual cash value.

Actual Cash Value: This option allows you to replace an item with something new, minus depreciation.

Generally, you can expect to pay around $2 per $100 worth of property you want to insure. So, if you are interested in covering $1,000 worth of equipment, you may pay around $200 for commercial property insurance.

Inland marine insurance costs

The only downside of commercial property insurance is that it doesn’t “follow” the covered items where they go. Commercial property insurance protects your equipment on your business premises and within a 500 feet radius.

If you want to protect your materials, goods, and equipment in transit or on a job site, you should consider inland marine insurance. Also known as contractor’s equipment insurance, this policy will protect your items as they move to different locations, or anywhere off-site.

The cost of this policy depends on the cost of the items you would like to insure. As an example, if you’re interested in $10,000 worth of coverage, you might pay around $250 annually for an inland marine policy.

Handyman package insurance costs

How can handymen get a lower price on general liability and commercial property insurance? A good option for handymen is a business owner’s policy, also known as a contractor package policy. This bundled policy combines both general liability and business property insurance into a package deal. With a contractor package policy, handypersons can get more coverage at a lower price.

Contractor package prices fluctuate by state and insurance provider. Rates also vary based on what your handyman work involves. Those who face more risk, or require more tools and equipment, will most likely have a higher premium.

All contractor package policies have minimum premiums, which is the absolute lowest price available to pay for a policy. Minimum premiums depend on where you live and what insurance provider you are working with. The insurance companies we work with offer varying minimum premiums, from $250 to $500 per annual policy. However, for a handyman, the cost usually hovers around $500 per year for a contractor package policy.

How much is workers’ comp for handymen?

There are always risks involved with physical jobs like handywork. Workers’ comp, also known as workman’s comp, protects you (and your employees if you have them) against job-related illnesses or injuries.

The cost of workers’ comp for handymen depends on a few factors, including:

Location

Most workman’s comp rates are set by the state. Because all states have different requirements, not all prices are the same.

Line of work

All job classifications have a specific workers’ comp code. The class code for handymen and carpenters is 5645. All class codes have state-specific rates, which vary by insurance company.

For example, in Virginia the classification rate for a handyman is $9.50. This rate is then multiplied by your payroll and your mod, which we delve into next.

Number of employees

Workers’ compensation rates are based on payroll (per $100). Let’s say your payroll is $10,000. Your “payroll per $100” would then be $100.

To calculate the price of your policy, you would multiply your classification rate by the “payroll per $100”.

100 x $9.50 = $950

Now that you have this number, there is one more element to be calculated, which is your mod.

Your claims history

Experience mods are a reflection of your claims history. If you have had no claims, you will have a low mod of 1.00 or below. If you have filed claims previously, your mod will be higher than 1.00.

The reason you want a low mod is because this number is multiplied by the two factors above to calculate the cost of your workers’ compensation insurance. So how does it work?

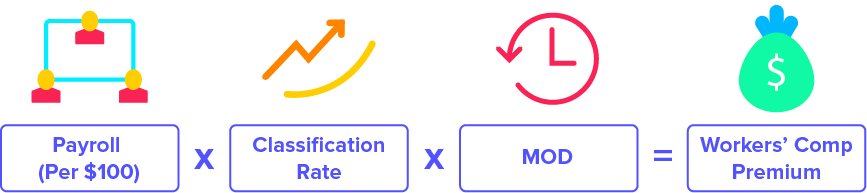

Workers’ comp is calculated by the following formula:

An additional factor includes the expense constant, which covers administrative fees. This usually costs around $200. Based on where you live and the type of work you do, prices can average around $2,825 per year for workers’ compensation insurance for handymen.

Additional insurance costs

- Commercial auto insurance: Want to cover vehicles your business owns? The cost of a commercial auto policy averages around $750.

- Hired & non-owned auto insurance: Do others drive their personal vehicles on behalf of your business? Or do you hire, rent, or borrow vehicles for work? You might be able to add this coverage onto your commercial auto policy for around only $100 more, give or take.

- Commercial umbrella insurance: This policy acts as a booster to your other commercial policies. What this means is that if you have a claim that exceeds your policy limits, your umbrella policy will kick in. You can usually get an umbrella insurance policy for somewhere between $500 and $2,500 a year.

- Surety bonds: You could be required by your local government to get a permit bond or license when you apply for things like contractor’s licenses, building permits, and more. Handymen licenses and permit bonds usually cost somewhere between $100 and $200.

We can save you money

We compare over 30 top national insurance providers with just one form– for free. Just fill out a quick form about your business, and we’ll find you the best coverage and the best rates.