How much does business insurance cost auto repair business?

Protecting yourself from the risks of doing business will naturally cost you some money. And auto repair shop insurance costs can range widely. Business insurance costs can depend on the size and location of your shop, number of employees, payroll, sales and experience. And that’s just for starters.

Costs will also depend on how much coverage your shop needs. There are several affordable auto repair shop insurance quotes you want to look at, such as liability, property, garagekeepers, and workers’ comp for mechanics. We can help you figure out exactly what coverage is right for you. That way you only pay for what you need.

Below are some sample price estimates to give you an idea of insurance costs. That way you’ll know what to expect. But keep in mind that the only accurate way to know out how much it will cost is to fill out a simple form about your business. We compare over 30 companies to find you the most affordable rates… with just one form, and we do it for free.

Auto Repair Liability Insurance Costs

General liability insurance gives a good bang for your buck. Automotive repair shops need it because it protects against bodily injury and property damage that happen as a result of your operations.

Several factors affect the price of a general liability policy, including where you live. The rates aren’t all the same because not all states have the same rules and requirements. Rates can also vary by zip code within a state. Rates can also differ between urban and rural areas, even for the same industry.

Another element that affects price is your level of interaction with the public. Because you typically deal with your clients in person you face more risk of bodily injury and property damage. The more exposure you have to risks like these, the higher the price of your general liability policy.

General liability policies for auto repair shops can start around $600 for the year for a small operation. However, policies can of course become much more expensive.

Garagekeepers Insurance Cost

Garagekeepers can start around $800 per year for auto repair shops but can easily surpass $2500 for bigger shops. But figuring out the exact price is hard It depends on your business and the coverage you need. In particular, it will factor in the number of vehicles you typically attend to in a day.

Property Insurance Costs

Auto repair shops depend on many types of equipment to get the job done. Equipment and tools aren’t cheap – they’re an investment. If something gets damaged or stolen, it can your paycheck.

Property insurance provides protection for damaged, stolen, or vandalized items. It also covers damages from disasters like storms and fire.

The price of some property insurance for an auto repair shop can cost around $1000 per year, but it depends on where you’re located, what you want covered, and what your property is worth.

Replacement cost vs. actual cash value

Property insurance has two plans. You can choose how you want to be reimbursed for your losses – replacement cost or actual cash value.

Actual Cash Value: Lets you replace the item with something new, minus depreciation.

Replacement Cost: The amount of money necessary to replace, repair, or rebuild an item based on its current worth. This costs more than the actual cash value option.

Generally, you can expect to pay around $2 per $100 worth of property you want to insure. So, if you are interested in covering $10,000 worth of equipment, you may pay around $200 for commercial property insurance.

$10,000 / 100 x 2 = $200

Inland Marine Insurance Costs

The only downside of commercial property insurance is that it doesn’t “follow” the covered items where they go. Commercial property insurance protects your equipment on your business premises and within a 500 feet radius.

If you want to protect your materials, goods, and equipment in transit or on a job site, you should consider inland marine insurance (also known as tools & equipment insurance). It protects your stuff anywhere off-site.

The cost of this policy depends on the cost of the items you would like to insure. As an example, if you want $10,000 worth of coverage, you might pay around $250 annually for an inland marine policy.

Business Owner’s Policy costs

Want a lower price on general liability and property insurance? Get a business owner’s policy. You can get a lower price when you buy them together. You may be able to get a business owners’ policy from $50/month for an auto repair shop. Of course, it depends on a lot of factors including the size of your business.

The price is different depending on the state and insurance company. Rates also vary based on what your work involves.

For auto repair shops, the cost of a business owners policy can hover around $600 per year.

How much is workers’ comp for auto repair?

Physical jobs always come with risk. Workers’ comp, also known as workman’s comp, protects you (and your employees if you have them) against job-related injuries or illness. The cost of workers’ comp for mechanics and auto technicians depend on a few factors:

- Business Location: Each state sets its own workers’ comp rate. Because all states have different requirements, all the prices are different, too.

- Type of Work: All job classifications have a specific workers’ comp code. All class codes have state-specific rates, which vary by insurance company.

- Number of employees

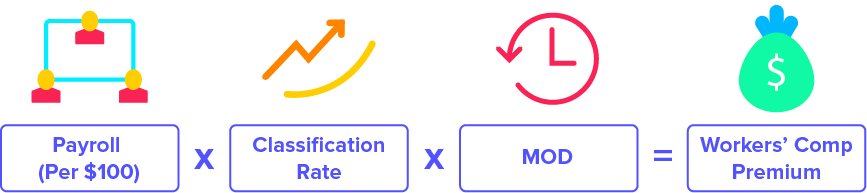

Workers’ comp rates are based on payroll (per $100). If your payroll is $50,000 that means your “payroll per $100” would be $500.To calculate the cost of your policy, you would multiply your classification rate by the “payroll per $100”.

500 (Payroll / 100) x $2.22 (Classification rate) X 1 (Experience Mod)= $1,110

- Experience Mod

Experience mods depict your claims history. If you have no claims, you will have a low mod of 1.00 or below. If you have filed claims previously, your mod will be higher than 1.00.You want to keep a low mod because. If you have a mod of 2 that means your WC rate can be double what a competitor’s rate is.

Workers’ comp for auto repair is fairly inexpensive. Here are some rate samples:

VA – $2.22

NC – $1.78

GA – $3.17

For example, in Virginia the class rate for auto repair is $2.22. Multiply that by your payroll and your mod (which is between 1 and 2 depending on loss history) to get your rate.

Workers’ comp is calculated by the following formula:

The last thing to keep in mind is the expense constant. It covers the admin fees to set up your account, and it’s usually around $200. Based on where you live and the type of work you do, prices can average around $1,110 per year for workers’ comp for auto repair shops with no claims and a payroll of $50,000.

Additional insurance costs

- Business Auto insurance: Want to cover vehicles your business owns? The cost of a commercial auto policy can cost around $750.

- Umbrella insurance: If you have a claim that exceeds your policy limits, an umbrella policy kicks in. You might be able to get one for somewhere between $500 and $2,500 a year. It just depends on how much extra coverage you want.

- Cyber Liability Insurance: If you want to cover your business from data breach and losses due to cyber incidents, this policy can start around $1,150 a year.

We can save you money.

We work with over 30 top national insurance companies. Just fill out a quick form about your business, and we’ll find you the best coverage for the lowest cost.