Cost Overview

How much does trucking insurance cost?

Many things determine how much trucking business insurance will cost. Many price factors can’t be changed (like the industry you work in). But some can be adjusted to reduce the cost, such as the amount of coverage needed. Below are some sample estimates that can give you an idea of what these policies may cost. But remember that the prices vary widely, and there are too many factors to calculate. The only way to really know what insurance will cost your particular business is to fill out a form about your business to see what the real costs are. With just one form we can find you the most affordable rates with the best value. And we do it for free.

Cost Factors

- Coverage included in insurance plan: Your insurance plan will vary widely based on the types of protections you and your business need–and each type of insurance policy has a different price range.

- Your Operations: The price will depend on certain “underwriting” factors that the unique circumstances of your business and the risks you face each day.

- Type of Vehicle: New trucks are usually more expensive to insure because they’re more expensive to replace or repair. Heavy vehicles cost more to insure because there’s an increased risk of causing more damage in an accident. And of course — the more you insure, the more the policy will cost.

- Operating radius: The cost will be higher the farther you drive. If you have a large operating radius, there’s more of a risk of getting in an accident because the routes are less familiar, and there’s just more time spent on the road in general.

- Location: Your rates will depend on the states your business operates in.

- Storage: The more secure the place you store your trucks when they’re not in use, the less your insurance will cost. Trucks parked in open lots or public areas will cost more than trucks parked in garages and closed yards.

- Cargo: Some cargo is more risky to carry because it weighs more, costs more, or is more dangerous in the event of an accident. That’s why the type of cargo you carry will affect the price of your policy. For example, an accident involving a truck carrying heavy construction equipment will likely cause more damage than a dump truck carrying a bunch of sand.

- Driving history: If a driver has a history of traffic violations, their insurance will cost more. The best thing you can do is make sure all drivers have clean records because even a minor speeding ticket could cause a big jump in price. It’s a good idea to consider investing in driver safety training; Many insurance carriers offer safety guides and resources. Any violation in your USDOT operating history is also something to consider if you’re working under your own authority.

- Deductible: Your deductible is the amount of money you pay out of pocket before your insurance kicks in. That’s why the higher your deductible is, the lower your insurance premium will be.

- Amount of coverage: Your policy limits, which is the maximum amount the insurance company will cover for a claim, will be a big determining factor in how much your monthly costs will be. The FMCSA mandates a minimum liability limit of $750,000 CSL, or $1,000,000 CSL for truckers who need a federal filing. (CSL is the combined single limit–the maximum your insurance company will pay per incident.)

Commercial Truck Insurance Cost

The national average cost data for commercial truck insurance from a particular insurer in 2020 ranged from $650/month for specialty truckers to $1,000/month for transport truckers. That includes a commercial truck policy with motor truck liability (also known as public or primary liability) and physical damage coverage. Keep in mind that is only an average from one insurer, and there are tons of unique factors that will affect your total trucking insurance cost. This average also assumes all the drivers have clean driving records.

Motor Truck Liability Cost

Also known as primary liability, it’s one of the most important coverages for a truck driver. Motor truck liability insurance can cost as little as $5,000/year. But it can be much more. It’s important to have since it covers injuries and damages to other people or property in the event of an accident.

Physical Damage Cost

Important because it covers damages to your truck. Many insurers will calculate the price of a policy around $3/month per thousand of a truck’s value. Here’s an example: Say a truck with a trailer is valued at $50,000. If the insurance company charges $3 per thousand that would come to around $150/month for physical damage coverage. (50 x $3 = $150/month).

If you decide to get comprehensive coverage you’ll be asked to provide a “Stated Amount”, which is the value of your truck. This is a big price factor for physical damage coverage. Make sure you carefully consider the mileage, make, model, etc, so you’re not over insuring your truck. It can be a good idea to check out some different resources that can give you a commercial truck blue book value.

Motor Truck Cargo Cost

Cargo insurance for truckers and haulers can often range between $425 to $2,000/per year. However, keep in mind that many things affect the price of cargo insurance, such as the policy limits and the types of goods you transport. For example, if you haul extremely valuable goods (such as medicine), your policy will way more than if you’re hauling dirt. We’ll help you shop different insurance companies that specialize in what you do.

Non-Trucking Liability Cost

Non-trucking liability insurance can start around $40/month, depending on how much liability coverage you want to purchase. It’s worth the price if you drive your truck for personal reasons because your commercial policies likely won’t cover those liabilities.

Occupational Accident Insurance Cost

Occupational accident insurance for truckers can cost somewhere between $1,500-$2,500 on average. But we have access to an Accident Policy with 24-hour coverage that is packaged with minimum premium workers’ comp that will beat even the state assigned risk price. Just ask us!

Truckers Workers’ Comp Cost

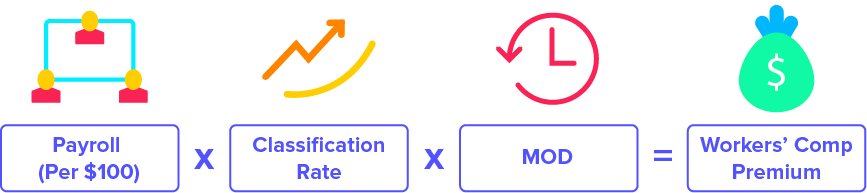

Workers’ comp costs can be one of the most challenging policies to calculate, as there are so many factors involved. It’s best to have a commercial agent evaluate your exact operation to see what it can cost (which we can do). A single driver with no employees who is excluded from workers’ comp coverage could pay less than $900/year for what’s called a minimum premium policy. But several things affect the price of trucking workers’ comp, like your state, profession, number of employees, and loss history.

- State Regulations: States regulate workers’ comp insurance, and because all states have differing rules and regulations, their rates differ, as well.

- Profession: Workers’ comp is all about risk. The riskier your profession, the higher your rate will be.

- Number of Employees: To calculate workers’ comp rates, you need to use the business’s payroll. The more employees you have, the higher your premium will be.

- Claims History: Your experience modifier. If you haven’t had claims in the past, great! Your “mod” should be around 1.0. If you have a poor loss history and your mod is near a 2.0, that means the price of your policy will be double.

Lastly, you have to factor in the expense constant, which simply covers admin fees. This tends to hover around $200.

Take a deeper look at Workers’ Comp Costs.

Truckers General Liability Cost

General liability insurance can be an affordable policy for many trucking businesses. But like most policies, the rates can vary widely. Many trucking business owners might pay around $550/year for a general liability policy. Learn more about general Liability insurance costs.

Trucking Umbrella Costs

Umbrella insurance come sin $1,000,000 increments, and you can get an umbrella policy up to $50,000,000. An umbrella policy for truckers could cost as low as $1,000 per year as a starting point. But it depends on how much coverage you need and what risks you face. It’s a good idea to consider if your trucking insurance costs aren’t too much.

Why does trucking insurance cost so much?

People who drive for work are statistically at a higher risk of getting in an accident. You spend hundreds of hours on the road trying to meet deadlines while traveling to unfamiliar locations. To the insurance company, that means you’re a higher risk than someone driving for personal reasons. That’s what makes trucking company insurance costs so high.

Trucks are also larger than conventional cars, which poses higher risks. Insurance policies cost more when there are statistically more risks. That’s because they’re the one that pays for it when something goes wrong.

There are some things you can do to save money on trucking insurance. Generally, if your company has a good loss history, has been in business for more than 2 years, and has experienced drivers with good safety scores, you can get a more competitive rate compared to similar businesses.

Alternatively, if you’re a new trucking venture with inexperienced drivers and a bunch of losses, you’ll likely have to pay more for insurance. The most practical way to keep trucking insurance costs as low as you can is to stay safe and keep a clean record.

Compare trucking insurance rates.

The best way to find low cost trucking insurance is to shop around. If you fill out a simple form about your business, and we’ll compare trucking insurance quotes to find you the best price. It’s the easiest way to save money, and we’ll help you do it at no extra cost.