How much is insurance for subcontractors?

The cost of business insurance for subcontractors depends on many factors, like the size of your operation, how many people you employ (if any), and the type of work you perform.

Below you’ll find sample cost estimates for various subcontractor insurance coverages. Please remember that these are just general estimates to be used as a reference and that commercial insurance varies greatly depending on where you operate your business, what you do, and what you want to cover. You’ll need to get a free estimate if you want to determine your specific insurance costs. We’ll compare over 30 top insurance companies to find you the best rates based on the information you provide about your business.

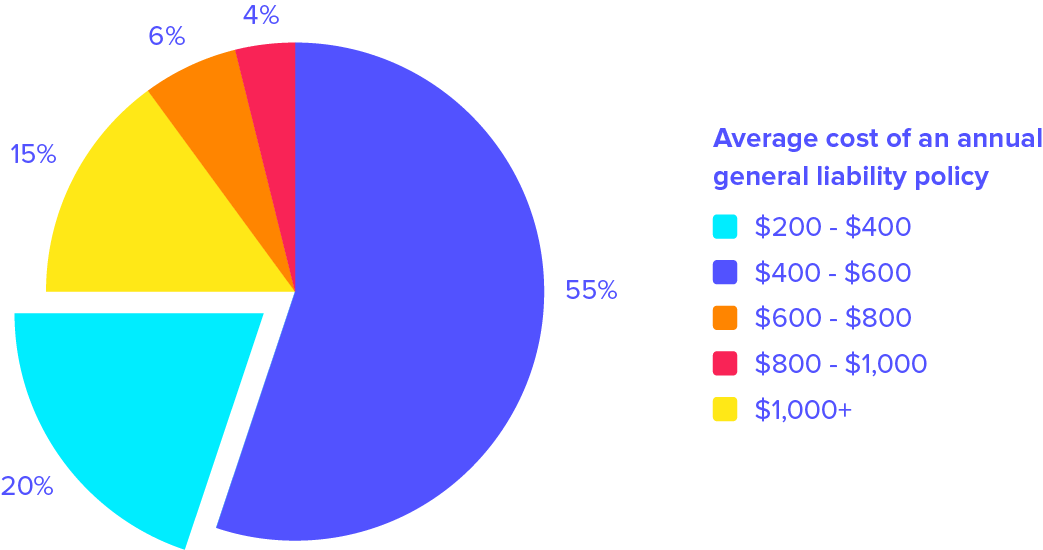

How much is liability insurance?

General liability insurance protects you from a variety of incidents that may result from your operations. It provides coverage for bodily injuries, property damage, and lawsuits or settlements.

Coverage examples include:

- Customer injuries caused by your operations.

- Damage to clients’ homes, appliances, furniture, or other types of property.

The cost of general liability insurance averages around $500 to $800 per year for subcontractors, depending on your trade.

How much does commercial property insurance cost?

Commercial property insurance is an important coverage that protects your tools, equipment, inventory, furniture, and fixtures. Whether you rely on high-powered drills, alignment tools, or custom harnesses to get the job done, subcontractor equipment isn’t cheap.

Investing in tools and supplies can really add up. Property insurance will reimburse you if your commercial property gets lost or damaged due to theft, fire, vandalism, or other unforeseen circumstances.

Depending on how many items you would like to cover, the worth of those items, and a few other factors, contractor’s equipment insurance typically costs somewhere between $400 to $1,200 per year for subcontractors.

How much is inland marine insurance, or floater insurance?

Inland marine insurance, or contractor’s equipment coverage, protects your tools and equipment while they’re away from your business premises. This is critical coverage for construction subcontractors, as you usually take your equipment with you from job site to job site.

A common misconception is that your commercial property insurance covers your items at all times. This is not the case. In reality, the equipment coverage ends after you’re 500 feet away from your business premises.

To protect your equipment off your business premises, whether it’s in transit or at another location, you should consider contractor’s equipment coverage. Subcontractors typically pay around $550 to $1500 per year for this policy, depending on the items you want to insure.

How much is commercial auto insurance for subs?

A commercial auto policy covers vehicles owned by your business. If you get into an accident while driving, the policy will cover the cost of any repairs or lawsuits resulting from the accident.

Do not rely on your personal auto insurance while driving a vehicle owned by your business. Usually, work-related incidents will not be covered by your personal auto policy.

Commercial auto insurance usually ranges from $750 to $2,000 per year.

Note: Your commercial auto insurance typically does not cover vehicles you hire, rent, or borrow for work. For proper protection, look into hired & non-owned auto insurance. This policy also extends liability protection to your employees who use their personal vehicles on behalf of your business. This coverage is inexpensive, averaging around $100 / year.

How much is workers’ compensation for subcontractors?

Workers’ compensation protects you from work-related accidents, injuries, and sickness.

If you’re a construction subcontractor, workers’ compensation is a vital coverage to have for yourself because of the physical risks you face while working on construction sites. In fact, your contract usually requires you to have workers’ comp if you’re work as a subcontractor.

The cost of workers’ compensation for subcontractors typically ranges between $800 and $3,000 annually, but it depends heavily on the type of work you do. The more liability you face, the higher your rate may be. Another cost factor is where you live. Workers’ comp prices are state-specific, so because all states have different rules and requirements, prices vary.

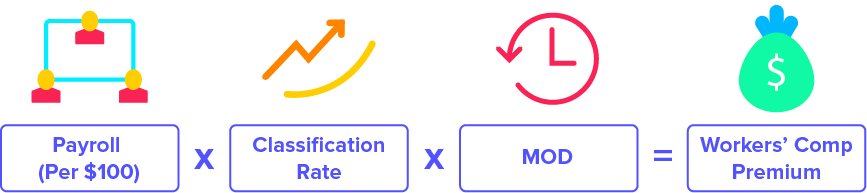

The cost of workers’ compensation is calculated by the following equation:

The chart below depicts the assigned classification rates for subcontractors.

Here, we will use Virginia’s 2018 rates as an example. Remember, numbers vary by state.

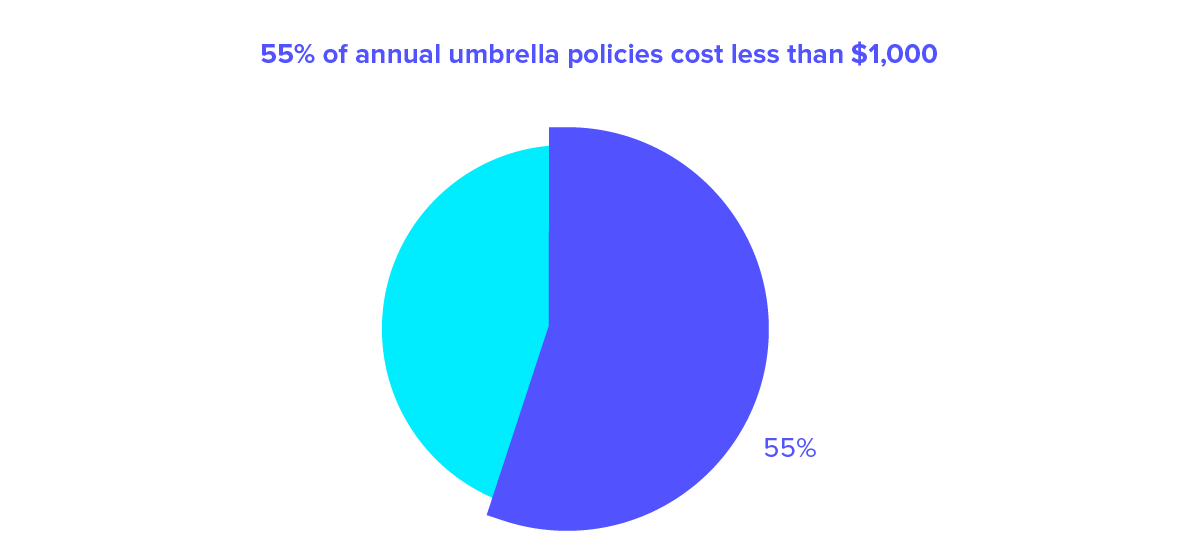

How much does umbrella insurance cost?

Umbrella insurance, also known as excess liability insurance, boosts the coverage limits of your underlying insurance policies. For example, let’s say you caused some pretty extensive property damage to a client’s home. Not only are you on the hook for the repair costs, you’re also facing a lawsuit. If your policy limits are set to $500,000, but the damages amount to $600,000, your umbrella coverage would kick in and pay the additional $100,000.

Excess liability insurance can increase your liability limits up to $1,000,000 worth of additional coverage. Subcontractors, if you want added protection on your liability insurance, you can purchase umbrella insurance for around $400 to $1,500 per year.

Affordable insurance policies for subcontractors

A contractor package policy, or business owner’s policy, combines general liability and property insurance into one packaged deal. Contractor package policies offer two coverages at a discounted price compared with purchasing each policy separately. With this package, you can save on your subcontractor insurance costs.

Commercial property insurance will reimburse your losses if your equipment, supplies, or tools get lost, damaged, or stolen while on your premises. And general liability insurance will protect you from common subcontractor mishaps and lawsuits.

The price of a business owner’s policy can be as little as $350 per year, but averages around $500 per year for subcontractors. The cost heavily depends on your trade, where you live, and the property you want to cover.

Low-cost workers’ compensation insurance

Required to have workers’ comp but don’t need the coverage? Many subcontractors who do not wish to be included in workers’ compensation coverage seek out minimum premium workers’ comp policies to satisfy their proof of insurance requirements. This is an option for subcontractors with no employees and who do not use other subcontractors. This is a very affordable option when it comes to workers’ compensation insurance.

We can save you money

Fill out a free quote, and we’ll compare rates from over 30 insurance companies to get you the best coverage at the lowest price. We offer free estimates with zero commitment.