Cost factors

Insurance prices will depend on what types of policies you need to secure for your operation. A good place for independent contractors to start is general liability insurance, commercial property insurance, workers’ compensation, and contractor package policies (aka business owner’s policies). Independent contractor insurance is probably more affordable than you think.

Business insurance rates vary depending on what you do, the size of your business, and where you work. Prices also fluctuate depending on the risks your operation faces.

Another important aspect that determines your insurance rate is your policy limits. Liability limits refer to the maximum amount an insurance company will pay for a loss. The level of limits you want on your policy is completely up to you — if your profession is considered to be low risk, you might feel comfortable choosing a lower liability limit. In doing so, the price of your policy would also be lower. Building a custom liability policy specific to you and your business allows you to pay only for what you need, nothing more.

Keep in mind that the only way to figure out how much your insurance policies will really cost is to fill out a quick form for a free estimate. With a single form, we compare over 30 insurance providers to find you the most affordable rates, and we do it for free.

To give you an idea on pricing, below are a few cost examples for insurance coverages best suited for independent contractors.

General liability cost for independent contractors

Typically, most independent contractors need liability insurance insurance, especially those who work in the construction industry. This policy is great for independent contractors, because much of your work presents risks that can be covered by a general liability policy. Another reason this liability policy is a good fit for contractors is because you visit job sites and interact with clients in person.

General liability insurance protects you from many of the common things that can go wrong when your work is physical, including third-party bodily injury and property damage.

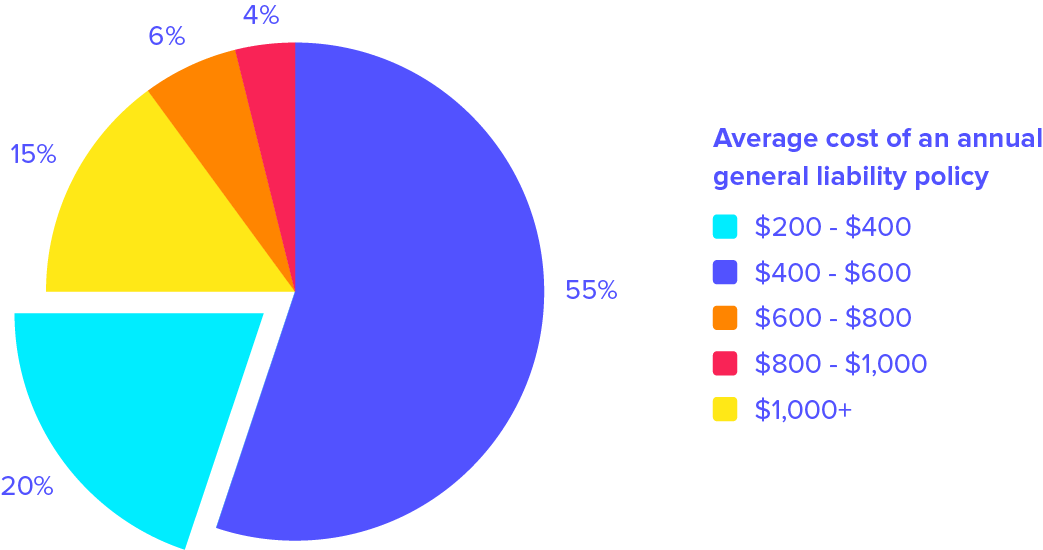

Fortunately, the price of the policy well is worth the value. Many small operations can expect to pay around $400 to $600 a year. Just to provide scope, the average cost of a customer slip and fall accident amounts to $20,000. A simple $35 a month could really save you (and your business) if an accident occurs.

Commercial property insurance costs

No matter what your trade, you depend on tools and equipment to do your job. Maybe you rely on nice power tool sets, or high-performance thermal cameras. It doesn’t matter if your tool of choice is a cutting-edge wall sander or self-leveling cross-line laser. One thing is for sure: Independent contractor tools aren’t cheap.

If your equipment gets damaged or stolen, that will affect your ability to finish the job you’re working on. Without the proper tools, you may not be able to finish your work, which could mean you’d be out of a paycheck.

With commercial property insurance, you’ll be covered if your business property is damaged, stolen, or vandalized. The policy will also cover damages caused by disasters such as fire, wind, and busted pipes on your premises and up to 500 feet from your premises.

Commercial property cost factors

The price of commercial property insurance depends on where you live, what you want to cover, how much your items are worth, and what kind of work you do. You can also choose how you want to be reimbursed for your losses — based on actual cash value or replacement cost.

Actual cash value: This plan would reimburse you for an item based on its cost when it was new, less the depreciation amount.

Replacement cost: Here, you’d be allotted the amount of money necessary to replace, repair, or rebuild an item based on its current worth. This plan is more expensive than actual cash value.

A smaller independent contractor operation could pay as little as $400 / year for commercial property insurance. However, the average price independent contractors pay for this coverage is around $750 / year. The more equipment you have, and the more its worth, the more you will pay.

Save money on insurance for independent contractors

If you’re interested in getting a little extra coverage for a better price, consider a contractor package policy, or business owner’s policy. This bundled deal combines general liability with commercial property insurance, which protects your tools, equipment, inventory, and so forth.

Contractor package policies provide added coverage, and at a lower price than purchasing each insurance policy separately. Depending on what you do and the size of your operation, you could pay as little as $250 / year.

Not only is it a better deal, but it’s also easy to add on extra protection. A popular endorsement is inland marine coverage, which is what protects your tools and equipment in transit or at a job site.

Inland marine insurance costs

Commercial insurance only protects your things within a 500-foot radius of your business premises. So, your business property protection doesn’t “follow” your covered items off-premises.

If you want to protect your equipment, materials, and other goods while in transit or at a job site, you’ll need inland marine insurance, often referred to as floater insurance or contractor equipment coverage. This coverage protects your items on the go and while at other locations.

The cost of inland marine insurance depends on the value of the items you would like to insure. For example, if you need $10,000 worth of coverage, you might pay around $250 per year.

How much is professional liability for independent contractors?

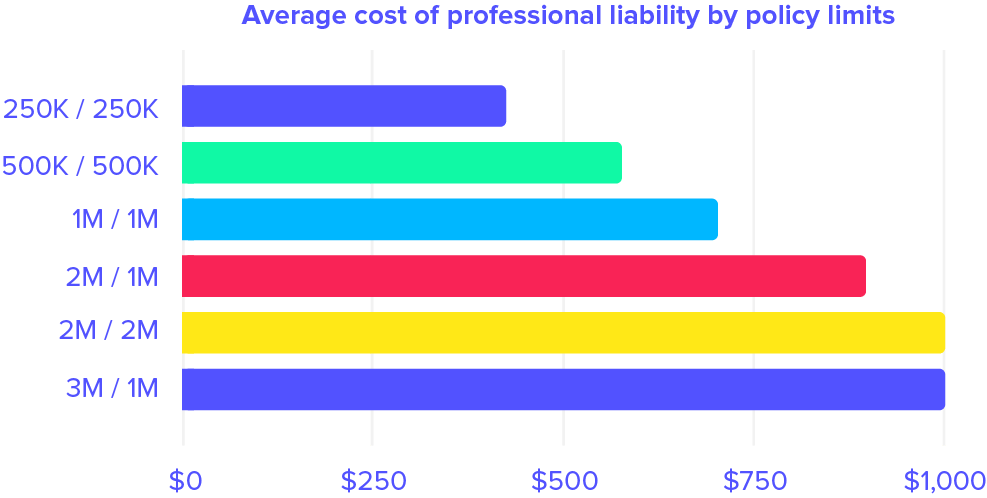

Like most insurance policies, your liability insurance rates depend on the level of risk associated with your work. If you’re performing simple tasks, you may not face the same liability as someone who is giving structural advice.

Professions with a lower level of risk include marketing consultants or business consultants. These types of independent contractors might pay around $600 a year for professional liability, also known as errors and omissions insurance. However, if you’re an architect or an engineer, your rates may be higher.

Another aspect that determines cost is how many claims other independent contractors in your industry have filed. If many people in your line of work have filed incidents, insurance providers sometimes raise prices for the industry as a whole. However, if few claims have been filed, the price will be lower due to good claims performance.

Other elements that affects price includes where you operate your business. Insurance rates and requirements vary by state, so keep that in mind. Additionally, the level of limits you place on your policy dictates the price. The higher your limits, the higher the price of the policy.

Cyber liability for independent contractors

Many independent contractors accept forms of payment by cash or check. However, if you do accept credit cards, you might want to consider cyber liability insurance.

Cyber liability protects your operations in the event that a customer’s personal information is stolen or exposed. This applies to something as simple as credit card information.

To ensure your business and your customers’ information is protected, think about getting cyber liability insurance. Most policies for independent contractors hover around $500 for the year.

How much is independent contractor workers’ comp?

The cost of workers’ comp depends on the following factors:

- Where you operate your business

- The type of work you do

- How many employees you have (if any)

- Your company’s claims experience

- How many claims have been filed in your industry

Additional insurance insurance coverages for independent contractors

- Commercial auto insurance: Want to cover vehicles owned by your business? Business auto insurance averages around $1,000 per year.

- Hired & non-owned auto insurance: Does anyone drive their personal vehicle on behalf of your business? Do you hire, rent, or borrow vehicles for work? Add this coverage onto your commercial auto policy for around an additional $100 per year.

- Commercial umbrella insurance: Umbrella insurance can boost the protection of your other commercial insurance policies. If you have a claim that exceeds your existing underlying policy limits, your umbrella policy will kick in. You can usually get umbrella insurance for between $1,000 and $2,500 a year.

We can save you money.

Complete an application in 10 minutes, and we’ll compare rates from over 30 insurance companies to get you the best coverage at the lowest price. We offer free estimates with zero commitment.