How much is business insurance for consultants?

Business insurance is something that’s important for all consultants to consider. Important consulting insurance policies to consider include general liability, professional liability, and workers’ compensation.

Costs will vary by coverage, liability limits, where you live, the size of your operation, and your line of work. Below are a few consultant cost estimates for each type of insurance policy. However, it should be noted that they are only rough estimates to give you an idea of what it might cost.

The only way to know how much insurance will cost for your business is to fill out a form to get a free estimate. We’ll compare over 30 insurance companies to find the lowest prices for the coverage you need. (At no extra cost.)

Cost factors

These are a few of the many things that will affect the price of your insurance plan.

The type of consulting you do and the specific risks your business faces

Insurance is all about protection from the risks you face while doing business. An interior design consultant typically faces less risk than a government construction consultant.

Number of employees

As your consulting firm grows, you’ll have to account for other people as well. This will affect your insurance costs.

Your revenue

The more you make, the more you need to protect. That means you’ll need more insurance coverage as well.

Claims history

If you’ve had a lot of claims, the insurance company will begin to think you are a risky customer.

Professional liability costs?

Professional liability insurance, or errors and omissions insurance, is one of the most important coverages for consultants to carry. At its core, it protects you against unhappy clients. In the event that your customer claims you failed to deliver promised services, were negligent, or made a professional error, professional liability will protect you. It also covers court costs and legal fees in the event that a client files a lawsuit.

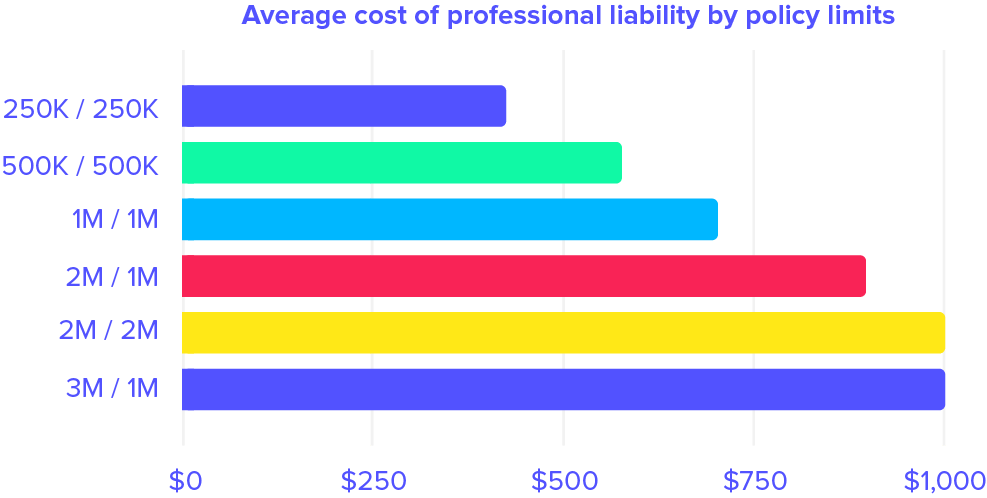

The price of professional liability insurance depends heavily on the limits of liability you select.

Liability limits refer to the maximum amount an insurance company will pay for a claim for the given policy period. Typical limits for this policy range from $250,000 to $5 million. The higher the liability limit, the higher the price of your policy. With such a wide range, prices can range from a mere $400 for a smaller policy to over $5,000 for a policy with the maximum liability limits.

Overall, the vast majority of consultants choose limits of $1 million / $1 million. With that, the price averages around $700 per year for professional liability insurance.

General liability costs

Because general liability insurance covers things like property damage and “slip and fall accidents”, one might think it’s best suited for those with a storefront or grocery store. However, if you have an office that welcomes clients, your business could be held liable if someone gets hurt on your premises, which is why it’s a necessary protection.

And even if you work from home, it’s important because it covers non-physical risks like copyright infringement, slander, libel, and false advertising.

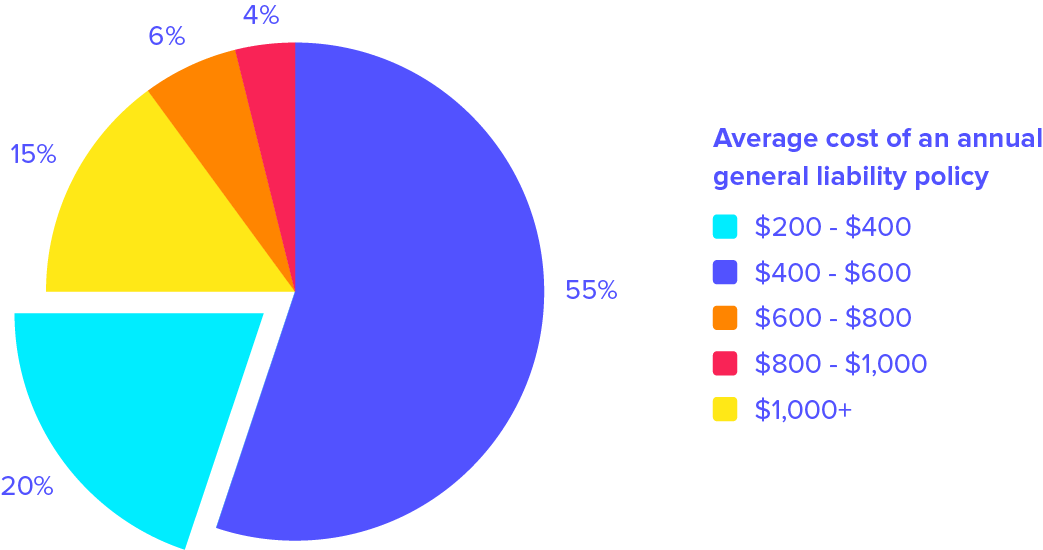

The cost of this policy varies based on what limits of liability you select. Most consultants choose $1 million / $2 million general liability policies, and that price averages just over $475 per year for small operations.

Consulting property insurance costs

Consultants rely on a variety of tools to perform their work, including printers, copiers, paper shredders, smartphones, laptops, and more. And you probably have nice office furniture and decor, as well. In the event of a fire, flood, burglary, or natural disaster, commercial property insurance will pay for the damages, including replacements and repairs.

If you’re a modest operation, you could pay as little as $400 per year for business property insurance. However, if you are looking to cover high-value items, you might pay around $750 per year. The price is based on the worth of the items you insure.

How to protect your commercial property outside your business premises

If you meet with clients off-site, you might bring some work gear with you. And depending on what you do, that could include things like important financial documents, papers, or drawings, among other valuable items or equipment.

Many people believe that their commercial insurance policy covers their things wherever they are. Unfortunately, that’s not the case. If your tools, equipment, or supplies are further than 500 feet away from your business premises, your business property protection ends.

In order to protect your items in transit or at another location, you should consider inland marine insurance, often referred to as a floater. The cost of this coverage is based on the worth of the items you are looking to insure. As a gauge, if you’re interested in covering $10,000 worth of commercial property, your policy may be priced at around $250 for an annual policy.

BOP: Reduced cost insurance for consultants

If you’re looking for a little more bang for your buck, consider a business owner’s policy, or BOP. This package combines both general liability insurance and commercial property insurance in a discounted offering. With BOP insurance, you’ll get coverage at a lower price than by purchasing each policy separately.

The price of a BOP is impacted by where you live, what you do, and the size of your operation. Smaller consultant operations could pay as little as $250 a year for a business owner’s policy.

Because this bundled deal includes general liability, limits of liability affect the price of business owner’s policies as well. Based on popular limits chosen by consultants, you might expect to pay just over $625 per year.

How much is workers’ comp?

As a consultant, you might be wondering if workers’ compensation is a fit for you. You’re working in an office, not on a construction site! But just because an office has relatively low risk, it doesn’t mean that you or your employees are immune from getting hurt or sick on the job.

If you have employees, you’re most likely going to be required by the state you reside in to cover your employees with workers’ comp. Even if they are not full-time. The price of this coverage depends on your payroll, so the more employees you have, the more expensive your policy will be.

In most states, you have the option to include or exclude yourself as the owner when you apply for workers’ compensation coverage. If you choose to include yourself, the policy would cover any work-related illnesses or injuries, and your income would be supplemented if you were unable to work while recovering.

Excluding yourself is the cheaper option, but including yourself might help you sleep at night. If you include yourself, a workers’ comp policy for yourself could be as little as $500 per year. If you have employees, the cost would obviously be higher.

Umbrella insurance costs

Many consultants choose to place an umbrella policy on their liability insurance. Umbrella insurance boosts the liability limits of an existing policy, meaning it provides excess liability. For example, let’s say your commercial auto policy has limits of $500,000. You get in an accident while running a work errand, resulting in $750,000 worth of damages. Your commercial auto policy will pay the $500,000 claim, and your umbrella would then pay the remaining $250,000 (depending on the limits you choose).

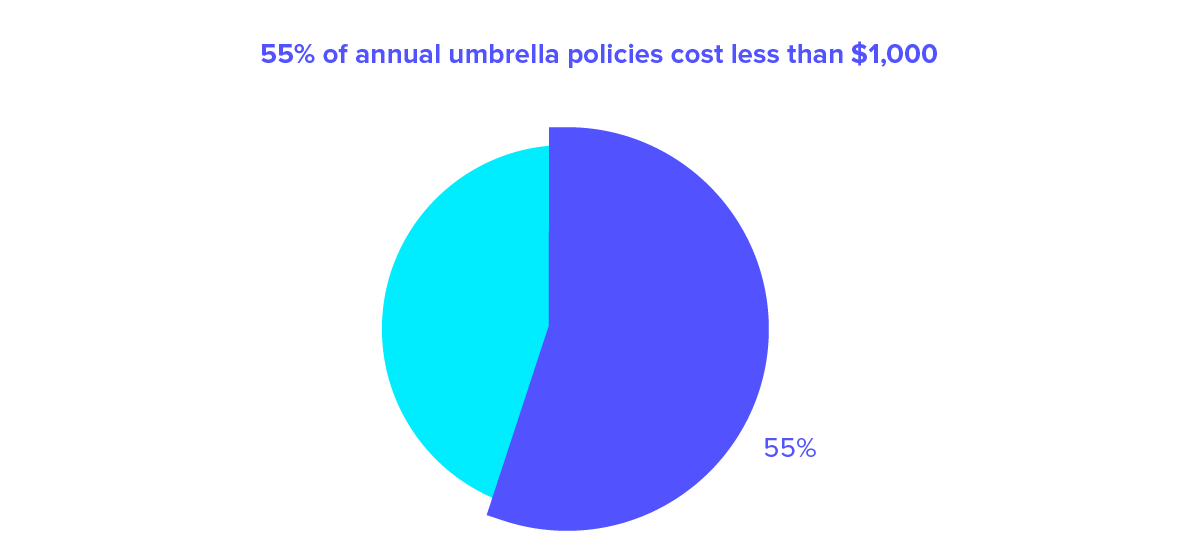

If you’re interested in purchasing umbrella insurance, consultants typically pay between $400–$600 per year.

We can save you money.

Fill out a simple form, and we’ll compare rates from over 30 insurance companies to get you the best coverage at the lowest price. We offer free estimates with zero commitment.